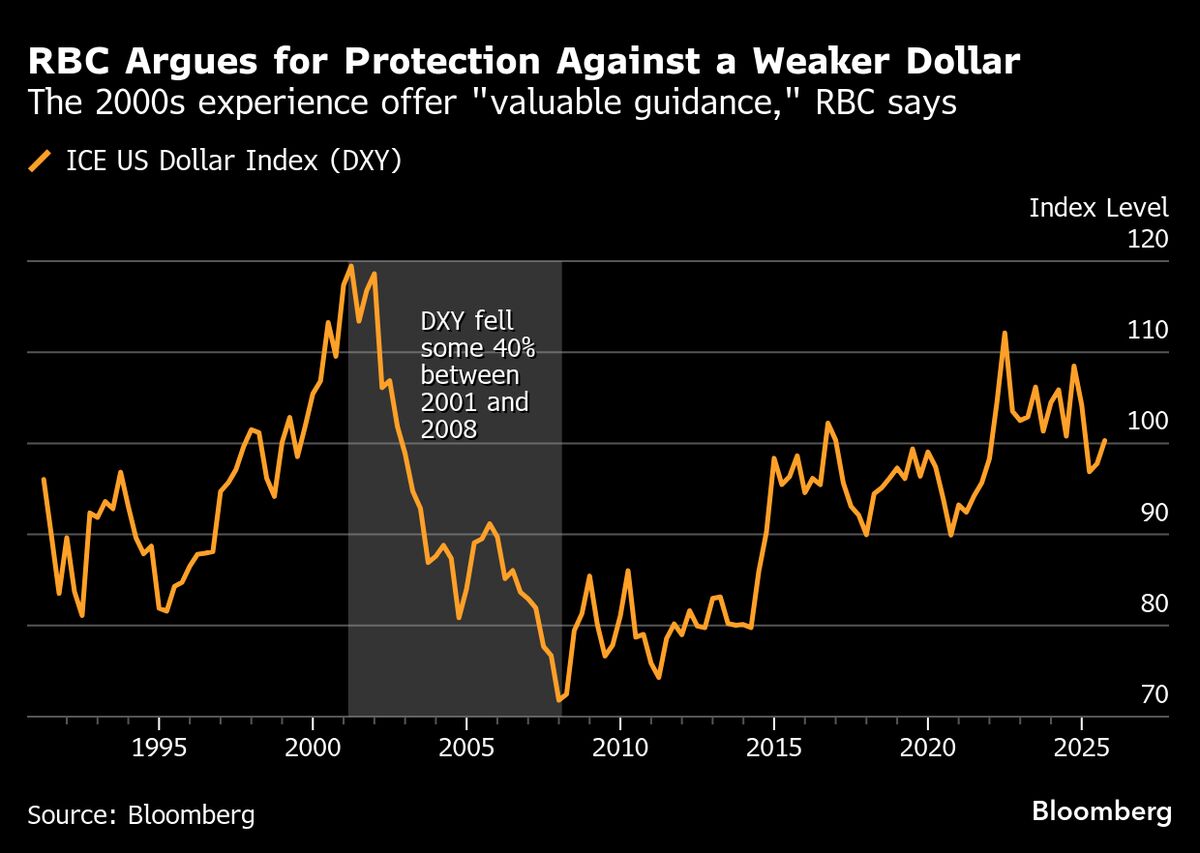

Gold Refuses To Crack: Bulls Dig In As Yields And Dollar Test Their Limits

PositiveArtificial Intelligence

Gold Refuses To Crack: Bulls Dig In As Yields And Dollar Test Their Limits

Gold is making a comeback after a period of decline, as uncertainty surrounding the Federal Reserve's next actions is causing market fluctuations. This resurgence is significant because it indicates a potential shift in investor confidence and could influence economic trends moving forward.

— via World Pulse Now AI Editorial System