Fed Rate Cut: How Will It Lower Your Credit Card and Mortgage Payments?

PositiveArtificial Intelligence

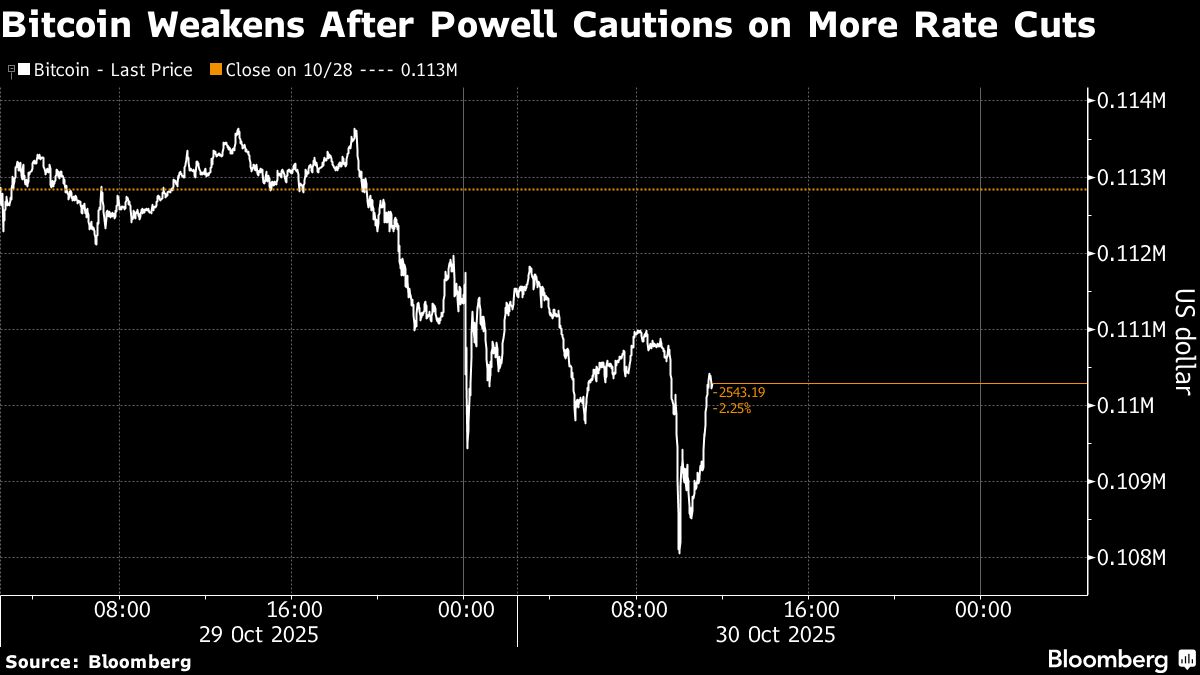

The recent Fed rate cut announced by Jerome Powell on October 29 has lowered the benchmark interest rate to between 3.75% and 4%. This move is significant as it is expected to reduce credit card APRs and mortgage rates, making borrowing cheaper for consumers. With inflation still a concern, this rate cut could provide much-needed relief for those struggling with auto loans and student debt, ultimately boosting economic activity.

— Curated by the World Pulse Now AI Editorial System