The Private Equity-Owned Data Center Behind Giant CME Outage

NeutralArtificial Intelligence

- A significant outage at the Chicago Mercantile Exchange (CME) was traced back to a private equity-owned data center, disrupting trading for over 10 hours and affecting global markets. This facility, located west of Chicago, handles an estimated $25 quadrillion in notional trade volume daily, highlighting its critical role in the financial ecosystem.

- The outage raised serious concerns about the reliability of the CME, which is a key player in futures trading for equities, bonds, and commodities. The incident not only halted trading but also left traders worldwide unable to execute transactions, prompting scrutiny over operational resilience and risk management practices.

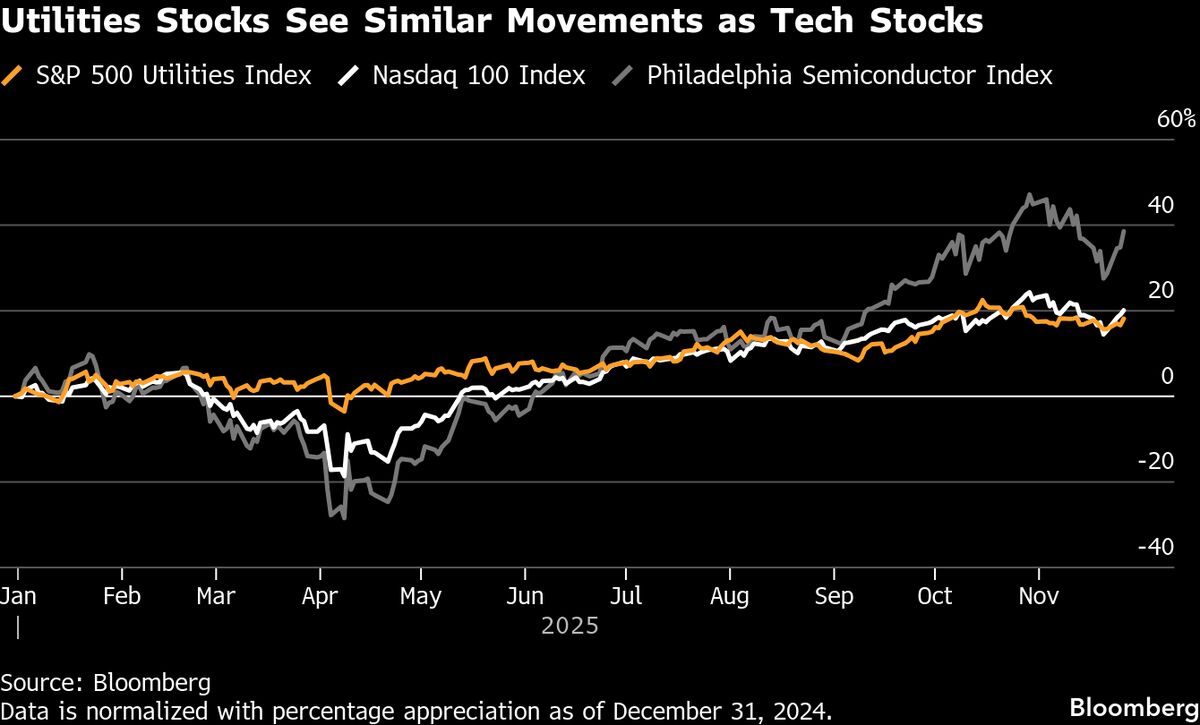

- Following the outage, the S&P 500 index saw a rally, indicating a recovery in market sentiment despite the disruption. This incident underscores ongoing vulnerabilities in financial infrastructure and the potential for significant market impacts stemming from technical failures, reflecting broader themes of dependence on technology in trading environments.

— via World Pulse Now AI Editorial System