High Private Tech Valuations Blur Investing Boundaries

NeutralArtificial Intelligence

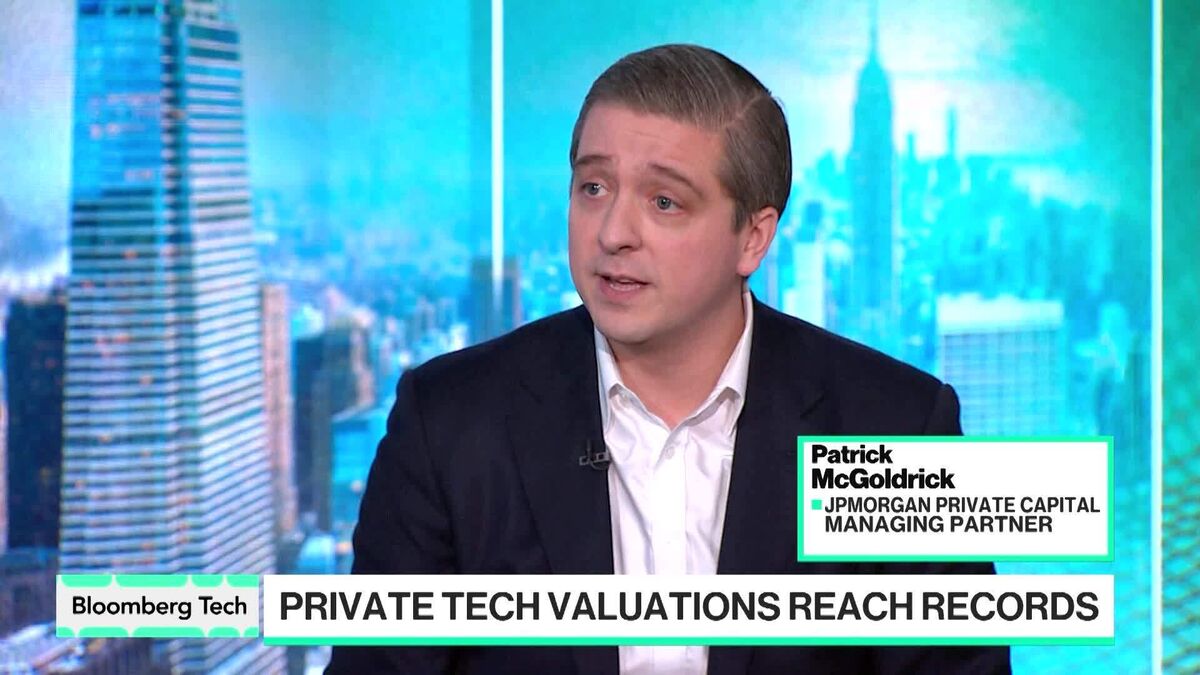

- Patrick McGoldrick, managing partner at JPMorgan Private Capital, discussed the increasing overlap between public and private markets, particularly in the tech sector, where companies are remaining private longer and achieving unprecedented valuations. This trend was highlighted during his appearance on Bloomberg Tech with Caroline Hyde.

- The implications of these high valuations are significant for investors and the broader market, as they challenge traditional investment boundaries and may influence future funding strategies and market dynamics in the tech industry.

- This development reflects a broader trend where venture capitalists are increasingly relying on artificial intelligence to inform their investment decisions, indicating a shift in trust towards AI's analytical capabilities. Additionally, concerns about the sustainability of tech stocks amidst rising AI spending and significant debt taken on by major tech firms further complicate the investment landscape.

— via World Pulse Now AI Editorial System