AI Spending Frenzy Echos Early Go-Go Days of Shale, Currie Says

NeutralArtificial Intelligence

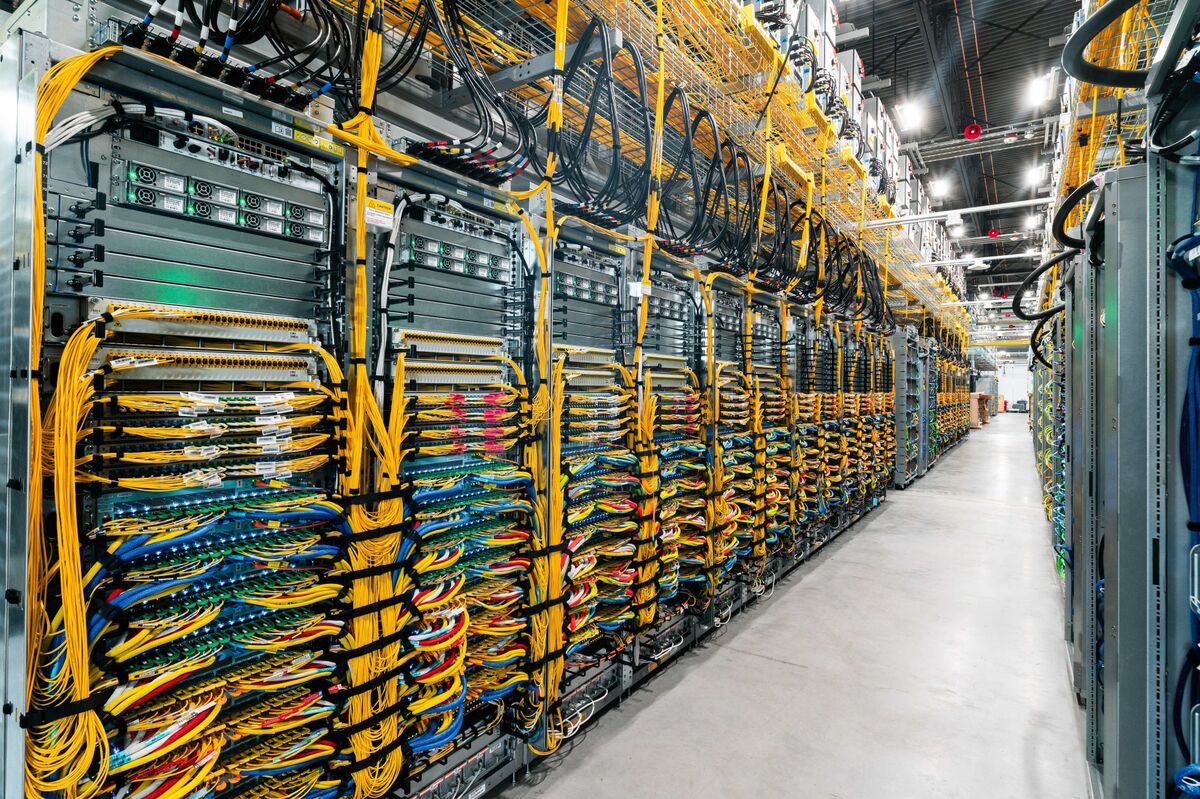

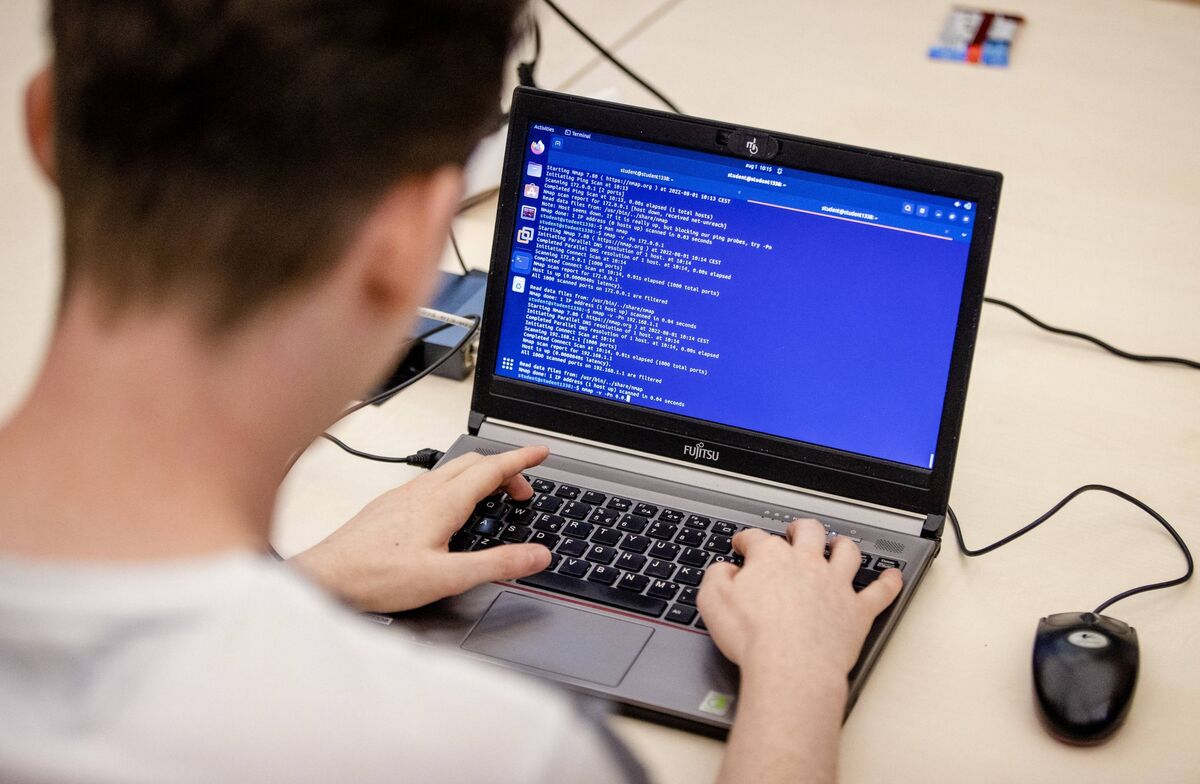

- Big Tech is currently experiencing a surge in spending on artificial intelligence, reminiscent of the shale industry's earlier investment boom, as noted by Jeff Currie of Carlyle Group Inc. This spending spree has raised concerns about the sustainability of such investments, especially in light of past market corrections that led to significant equity losses.

- The implications of this spending frenzy are profound for Big Tech companies, as they seek to expand their AI capabilities. However, the reliance on substantial debt to finance these expansions poses risks, particularly as investors grow wary of potential market bubbles and the long-term viability of these investments.

- This trend reflects broader anxieties in the financial markets, where the increasing levels of debt among Big Tech firms are raising alarms about the health of credit markets. The situation echoes historical patterns of rapid investment followed by sharp downturns, highlighting the precarious balance between innovation and financial stability in the tech sector.

— via World Pulse Now AI Editorial System