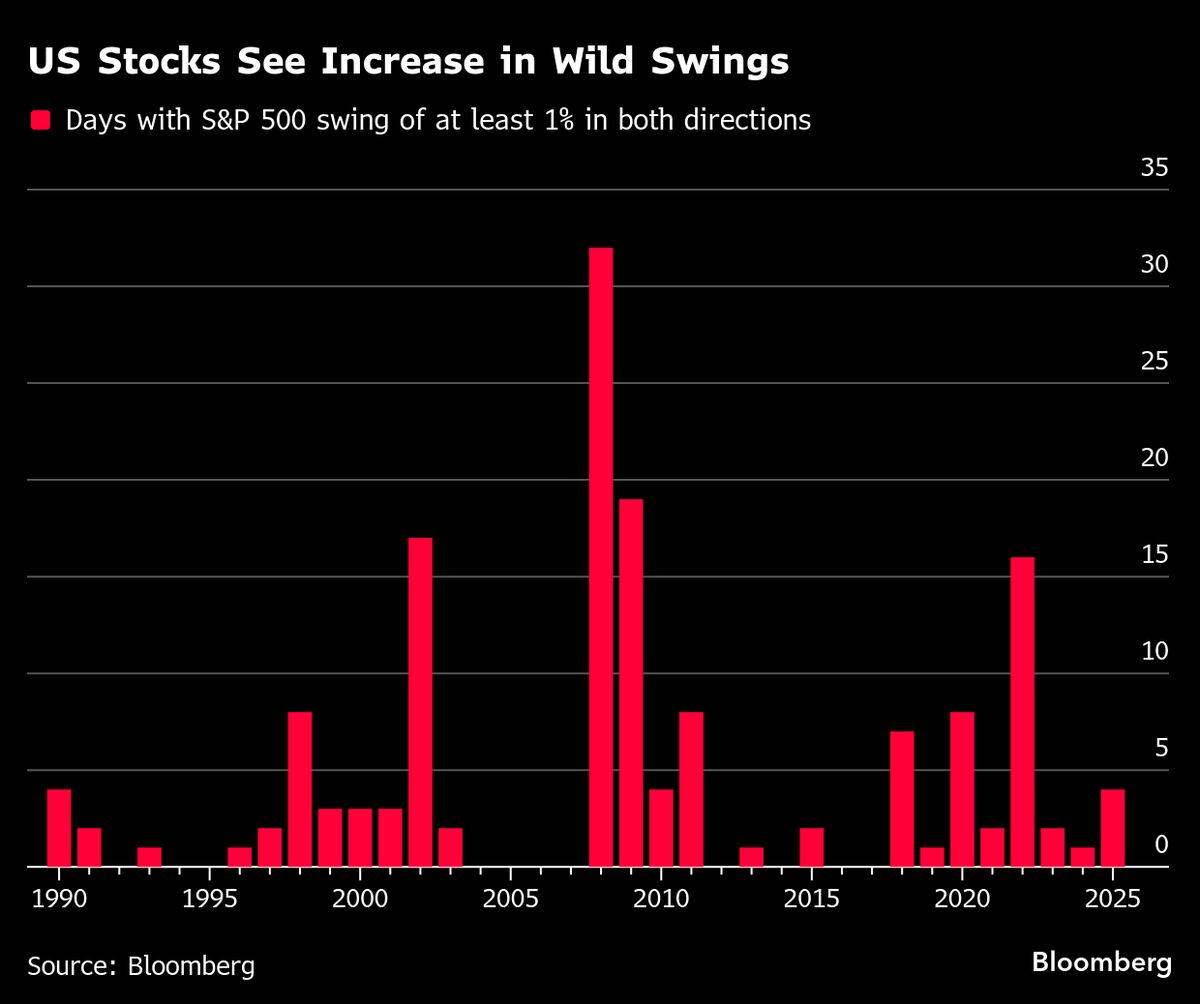

Wildest Trading Day Since Tariff Shock to Test Dip Buyers’ Nerve

NegativeArtificial Intelligence

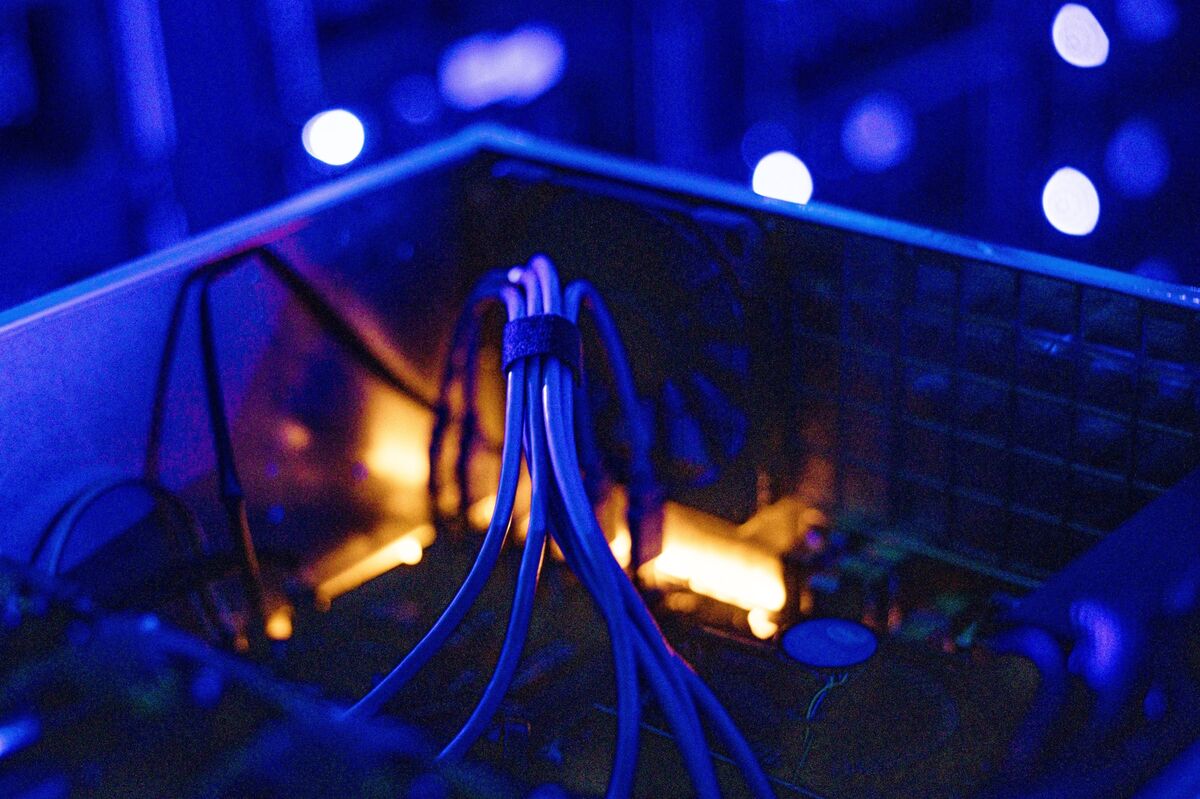

- Nvidia Corp. faced a challenging trading day as a strong earnings forecast failed to revive dip buyers, leading to a significant tech sell-off.

- This situation underscores the volatility in the tech sector, where investor confidence is shaken by mixed economic indicators and market instability.

- The broader implications highlight a growing skepticism about the sustainability of tech stock rallies, particularly in light of fears surrounding AI spending and potential market bubbles.

— via World Pulse Now AI Editorial System