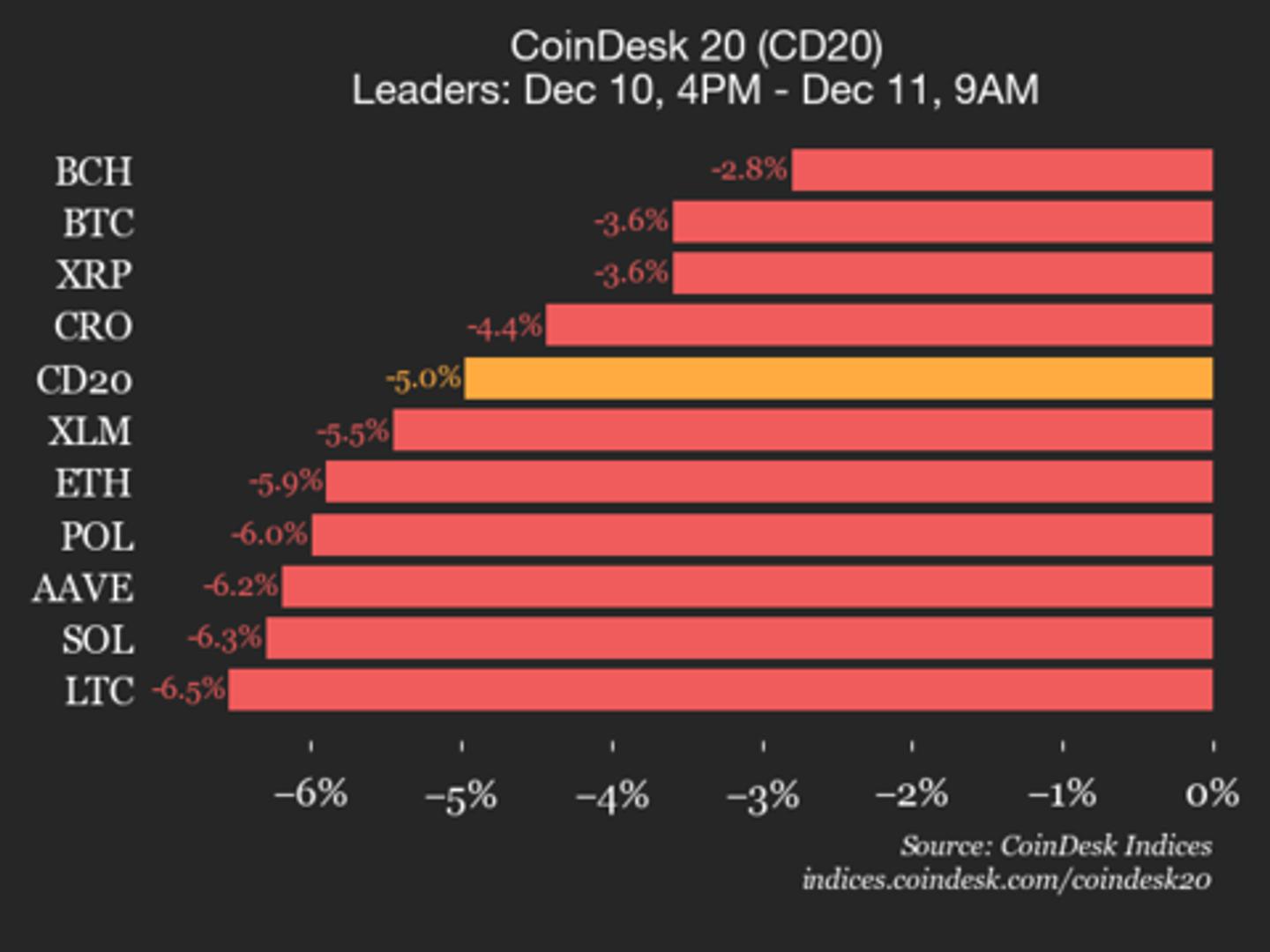

CoinDesk 20 Performance Update: Bitcoin (BTC) Drops 3.6% as Index Trades Lower

NegativeCryptocurrency

- Bitcoin (BTC) has dropped 3.6% as part of the CoinDesk 20 index, which is currently trading lower overall. This decline reflects a broader downturn in the cryptocurrency market, where many assets are underperforming amid increased sell pressure and reduced trading volumes.

- The drop in Bitcoin's price is significant as it indicates a loss of investor confidence and could lead to further liquidations of bullish positions, which have already seen $370 million wiped out in recent market activity. This trend may impact future trading strategies.

- The current market volatility is part of a larger pattern of bearish sentiment in the cryptocurrency sector, with analysts predicting a potential price bottom for Bitcoin in 2026. The ongoing fluctuations and sell-offs highlight the challenges facing investors as they navigate a cautious market environment.

— via World Pulse Now AI Editorial System