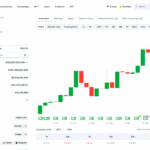

Google integrates Solana chart in search results

PositiveCryptocurrency

Google's recent integration of the Solana price chart into its search results is a significant step for cryptocurrency enthusiasts. This feature allows users to access real-time SOL price data and charts directly from their search queries, making it easier to stay informed about market trends. This move not only enhances user experience but also reflects the growing importance of cryptocurrencies in mainstream finance.

— Curated by the World Pulse Now AI Editorial System