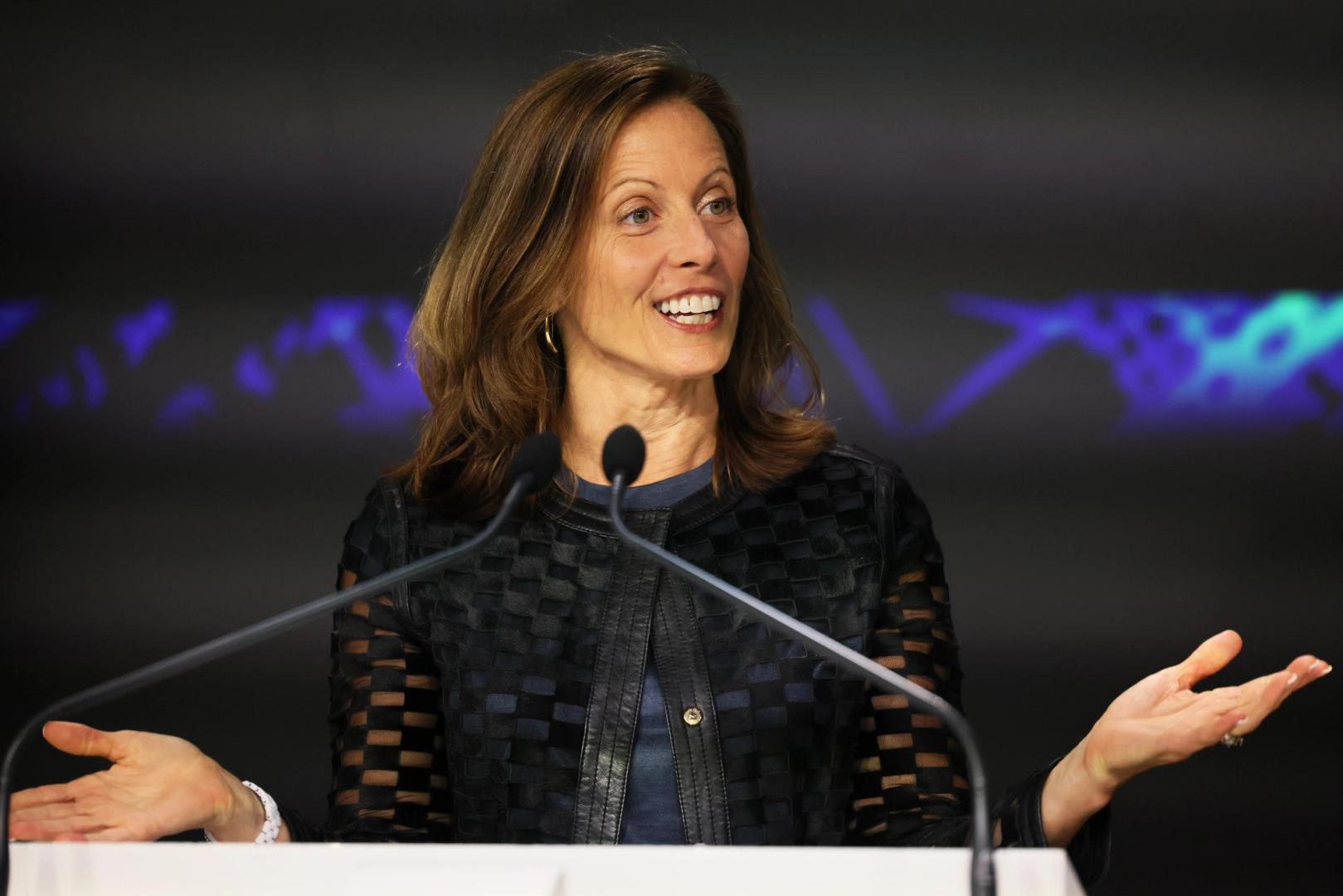

Cleaning Up Crypto ATMs Isn’t Anti-Crypto

PositiveCryptocurrency

The recent discussions around cleaning up crypto ATMs highlight the importance of regulation in the cryptocurrency space. While some may view this as an anti-crypto stance, it actually aims to enhance security and trust in the industry. By ensuring that these ATMs comply with legal standards, it fosters a safer environment for users and can ultimately lead to broader acceptance of cryptocurrencies in mainstream finance.

— Curated by the World Pulse Now AI Editorial System