Crypto’s Black Friday

NeutralCryptocurrency

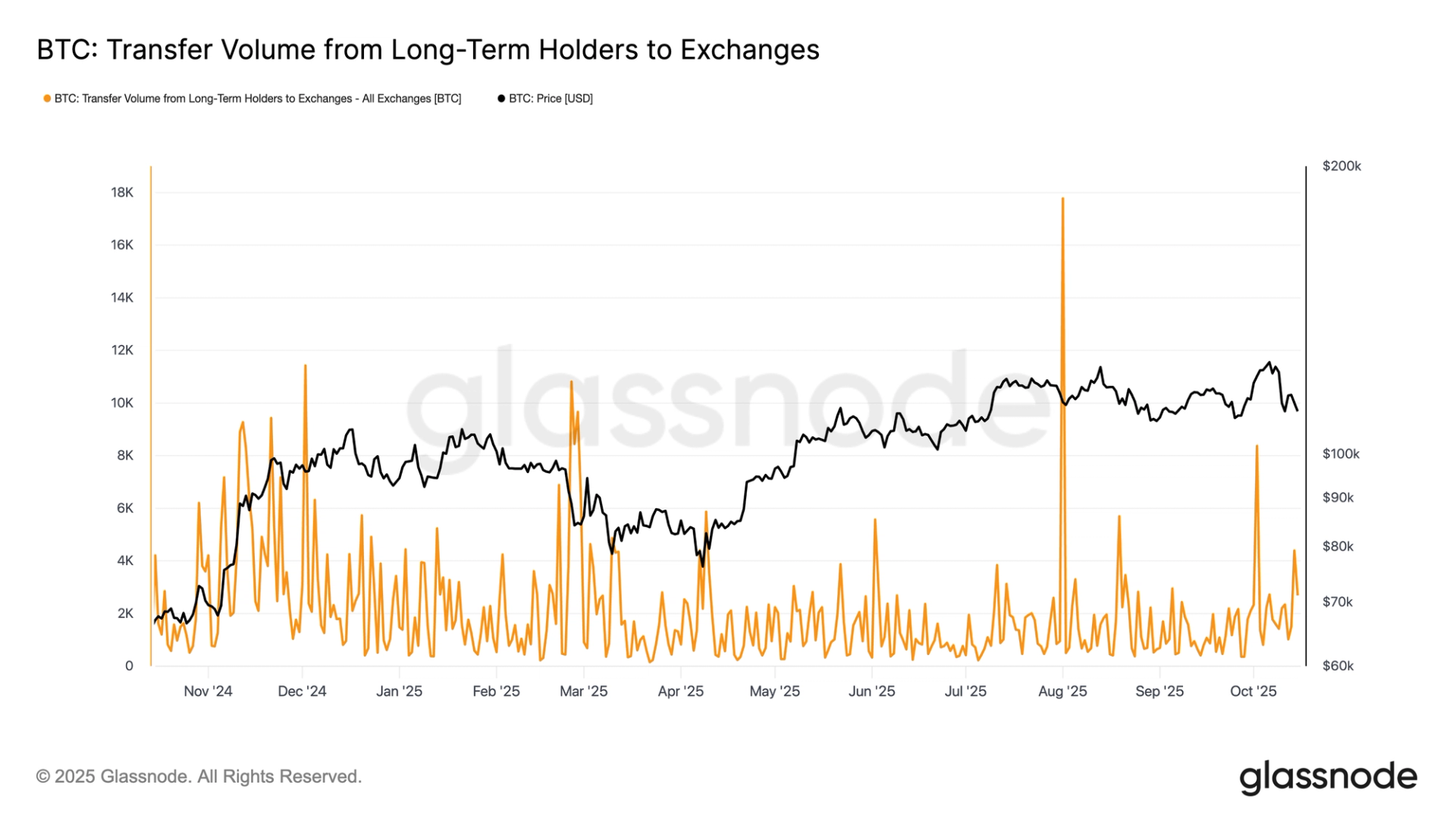

The recent event dubbed 'Crypto's Black Friday' highlights the interconnectedness of liquidity, collateral, and oracle systems in the cryptocurrency market. As the market faced significant stress, it became clear how these elements are tightly coupled, raising concerns about stability and risk management in the sector. Understanding these dynamics is crucial for investors and stakeholders as they navigate the evolving landscape of digital assets.

— Curated by the World Pulse Now AI Editorial System