Robinhood Stock Slides 8% After Big Decline in November Trading Volumes

NegativeCryptocurrency

- Robinhood's stock price fell by 8% following a significant decline in trading volumes across equity, options, and cryptocurrency markets in November, raising concerns about the waning momentum of retail investors. This downturn reflects a broader trend of decreasing trading activity in the cryptocurrency sector, as highlighted by various market analyses.

- The decline in trading volumes is critical for Robinhood as it directly impacts the company's revenue model, which heavily relies on transaction fees from trading activities. A sustained drop in investor engagement could hinder the company's growth prospects and market position.

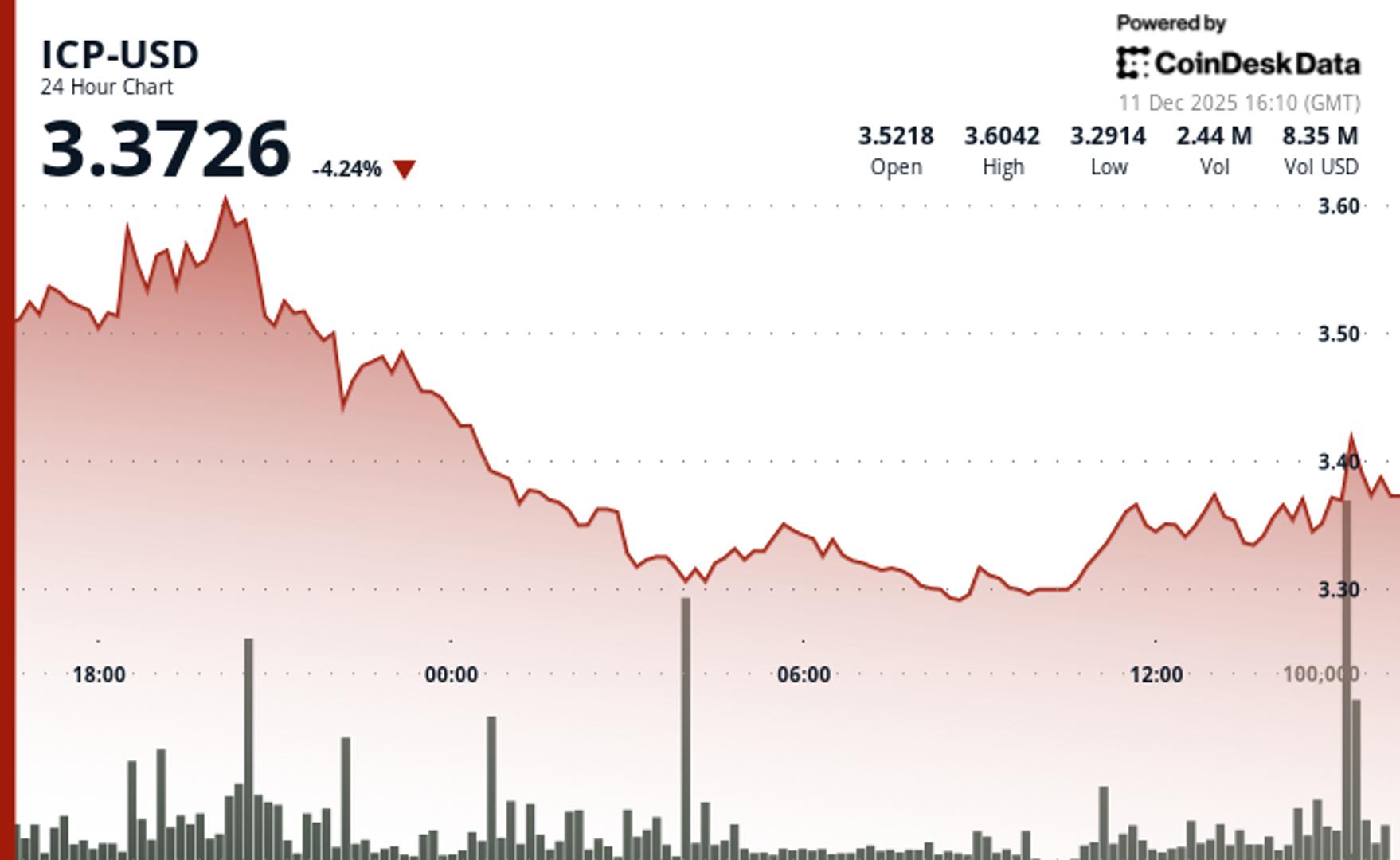

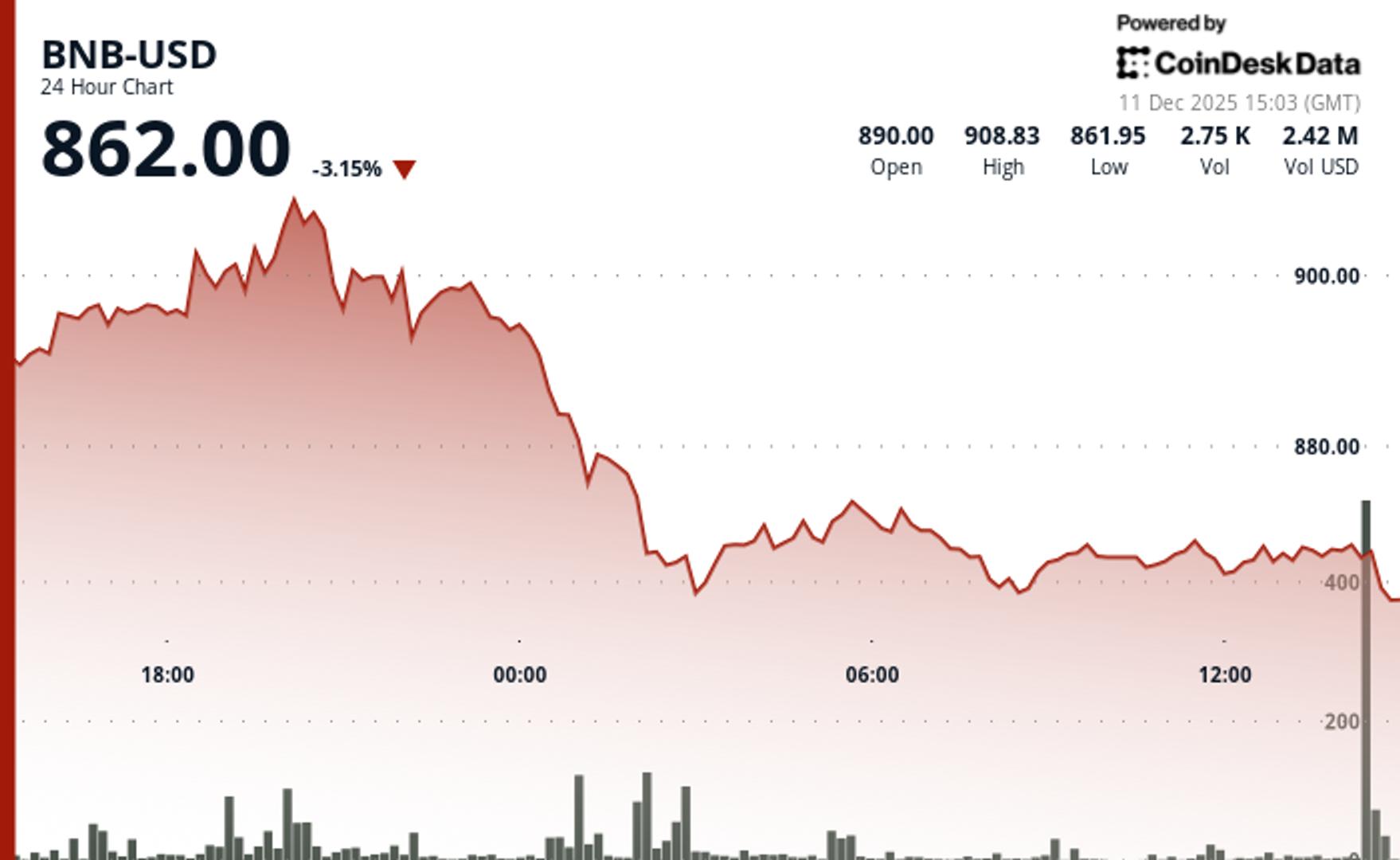

- This situation underscores a larger trend of volatility in the cryptocurrency market, with major tokens like XRP facing negative social sentiment and significant price declines. The overall downturn in trading volumes suggests a cautious investor sentiment, which could lead to further challenges for platforms like Robinhood as they navigate an increasingly competitive and uncertain market landscape.

— via World Pulse Now AI Editorial System