BNB price slides near $950 as market pullback deepens, can it reclaim $1,000?

NegativeCryptocurrency

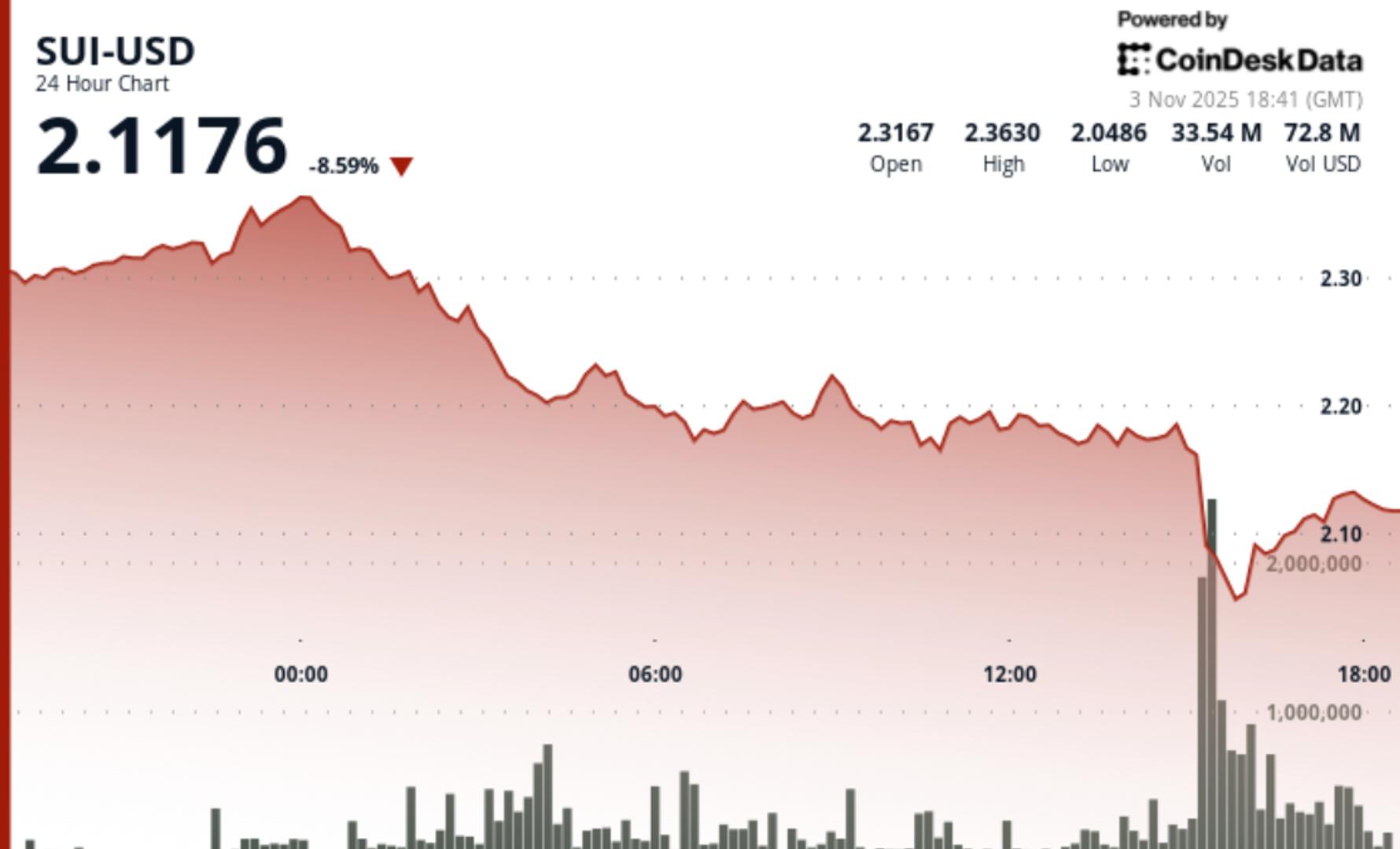

BNB's price has dropped to around $950 as the cryptocurrency market faces significant uncertainty, leading to a decline of 8.6% in just 24 hours. This downturn is concerning for investors, as it raises questions about whether BNB can recover and reach the $1,000 mark again. The situation highlights the volatility of the crypto market and the challenges that major tokens are currently facing.

— Curated by the World Pulse Now AI Editorial System