Whales Accumulate Millions in ADA as Bearish Momentum Persists, Can Cardano Repeat Its 60% Rally?

NeutralCryptocurrency

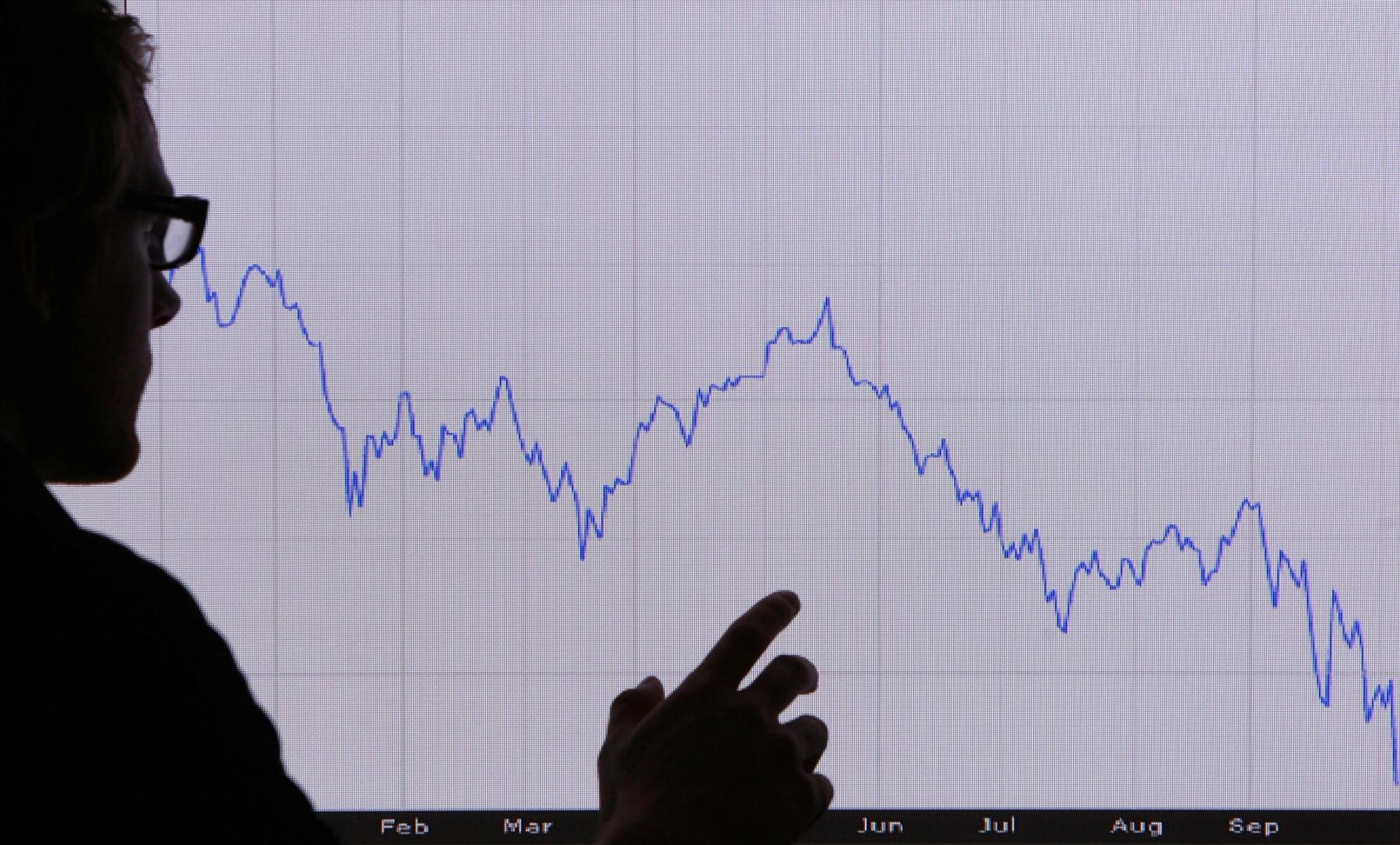

Cardano (ADA) has seen a slight decline of about 4%, currently trading at $0.64, which is below key moving averages. Despite this bearish trend, there is a notable accumulation of approximately 200 million ADA by whales, indicating confidence in the asset. This comes as developers are implementing significant upgrades, including the Hydra scaling solution. The situation is crucial as it could determine whether Cardano can replicate its previous 60% rally, making it a point of interest for investors.

— Curated by the World Pulse Now AI Editorial System