Bitcoin STH Whales Recover: Unrealized Profits Return

PositiveCryptocurrency

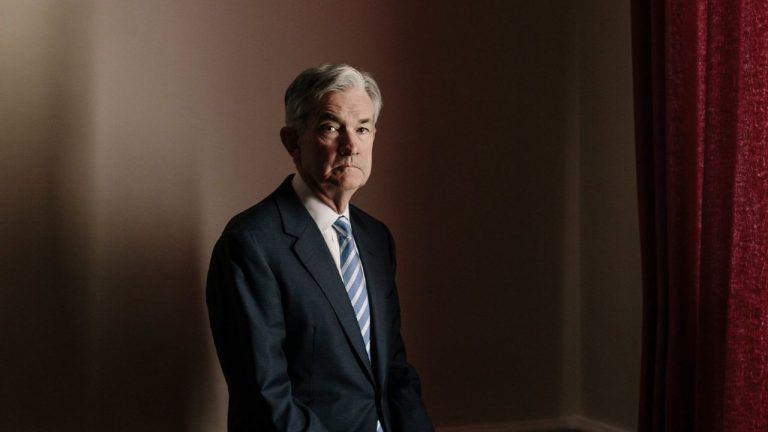

Bitcoin is stabilizing around $115,000 as traders await the Federal Reserve's upcoming meeting. After a period of volatility, the market is in a cautious holding phase, with many looking for guidance on interest rate decisions.

Editor’s Note: This matters because the Federal Reserve's decisions on interest rates can significantly impact risk assets like Bitcoin. A clear direction from the Fed could lead to increased confidence among traders and potentially boost the market.

— Curated by the World Pulse Now AI Editorial System