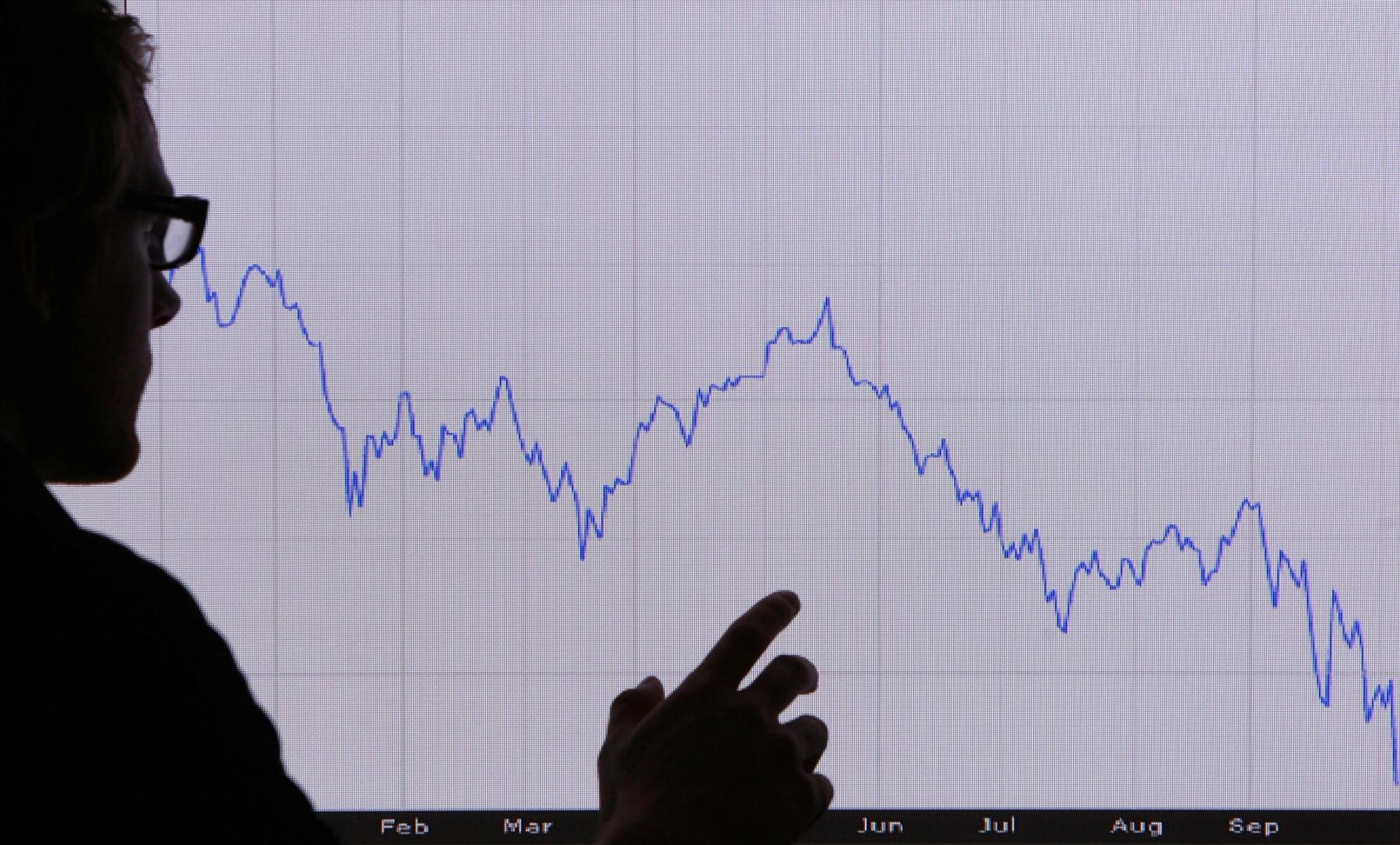

Crypto Markets Today: Bitcoin, Ether Drop as Selling Pressure Returns

NegativeCryptocurrency

Bitcoin and Ethereum experienced a significant drop on Tuesday, reversing the gains made over the weekend. This decline raises concerns among traders about the sustainability of the recent market bounce, as they evaluate whether it has created a lower high. Understanding these fluctuations is crucial for investors as they navigate the volatile cryptocurrency landscape.

— Curated by the World Pulse Now AI Editorial System