Here’s Why The Bitcoin, Ethereum, And Dogecoin Prices Are Crashing Again

NegativeCryptocurrency

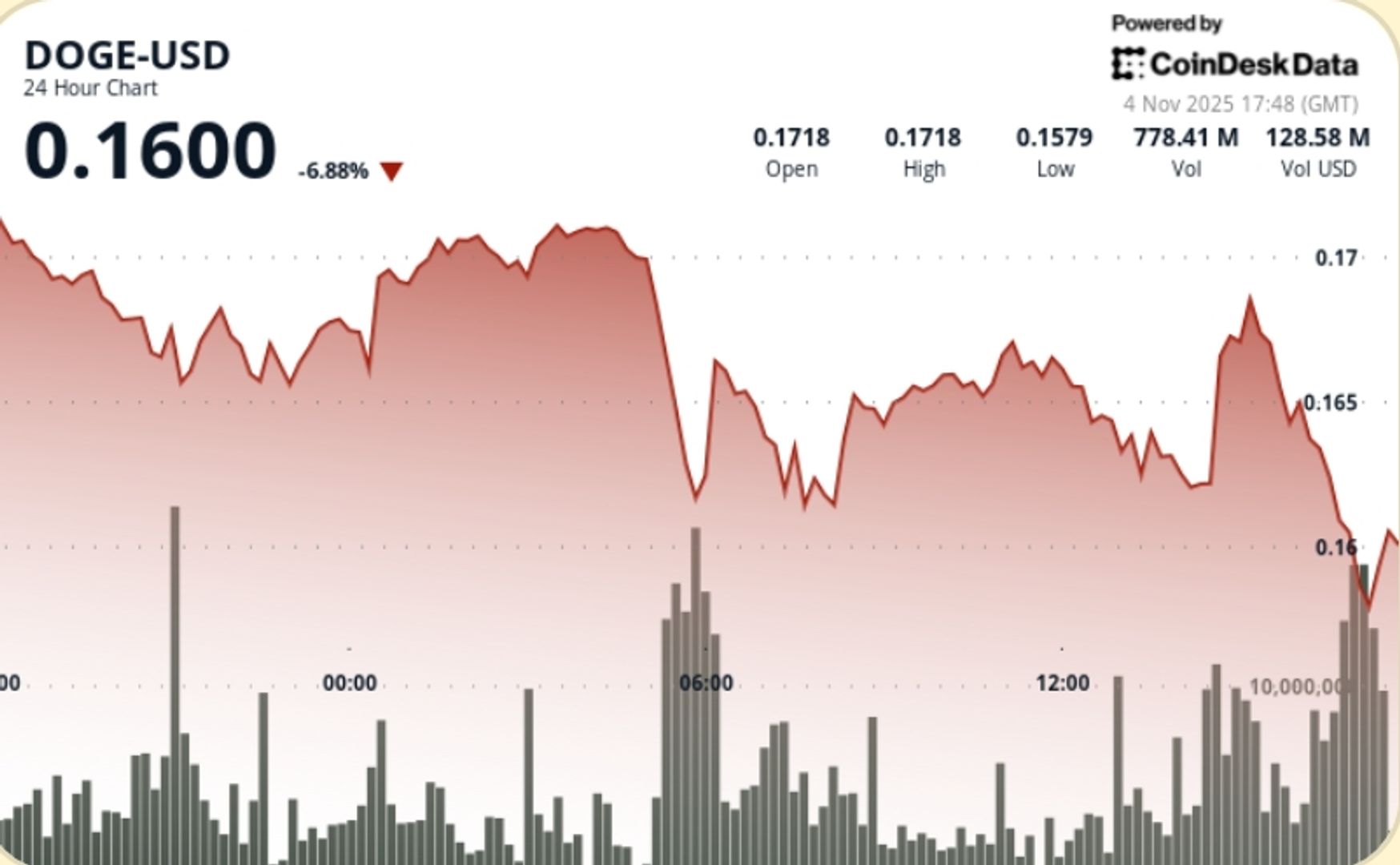

The cryptocurrency market is facing a significant downturn, with Bitcoin, Ethereum, and Dogecoin all experiencing sharp declines. In just 24 hours, the market dropped by 4.1%, pushing major cryptocurrencies below critical support levels. This sell-off was fueled by rumors that Wintermute, a key player in the market, is planning to sue Binance over issues related to a recent crash. This situation is concerning for investors as it raises questions about the stability of the market and the potential for further declines.

— Curated by the World Pulse Now AI Editorial System