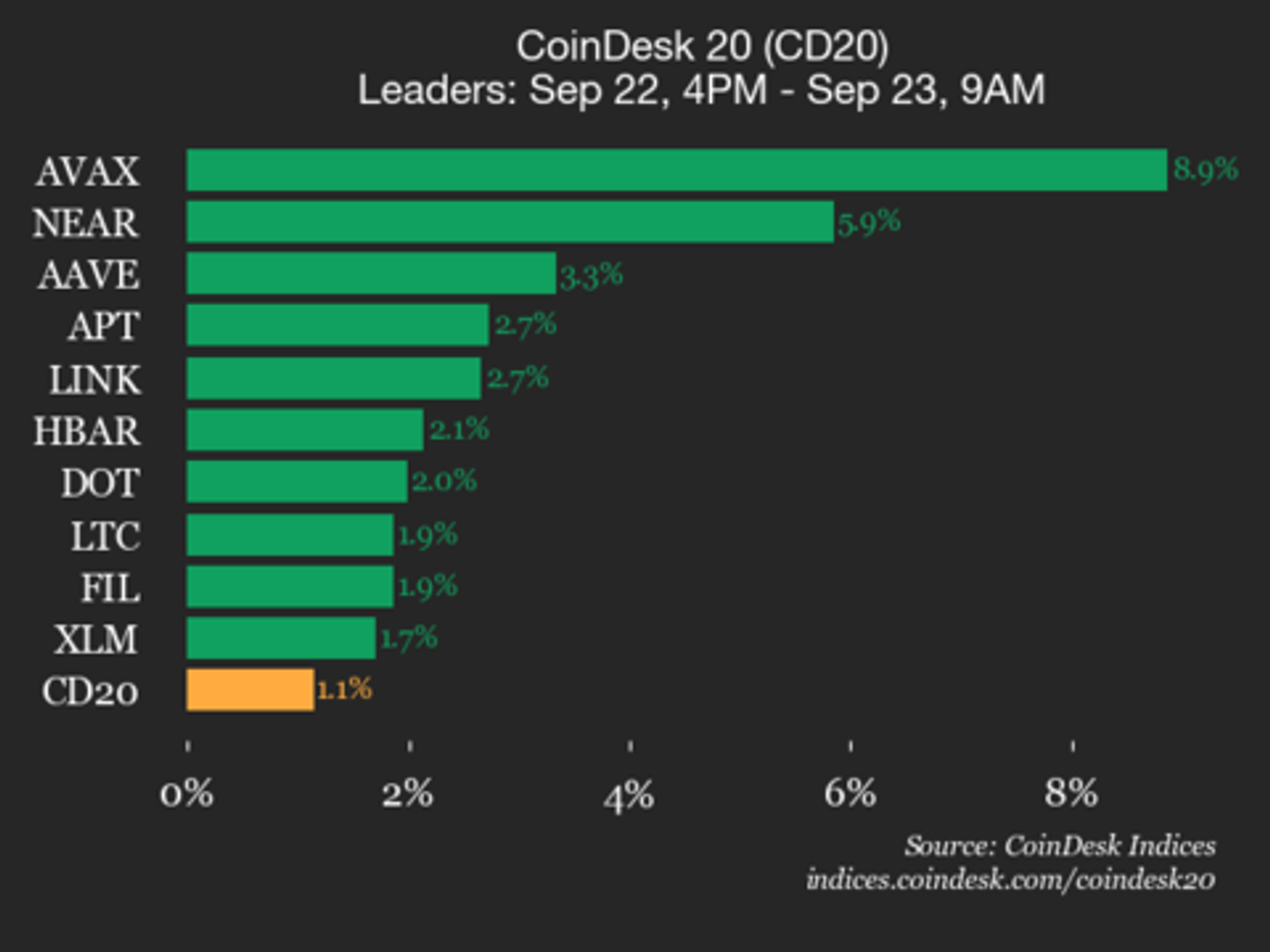

World Liberty adviser bets millions as corporate treasuries fuel AVAX rally

PositiveCryptocurrency

The recent announcement by AgriFORCE to pivot $550 million into Avalanche's treasury has sparked a significant rally in AVAX prices, prompting World Liberty Financial adviser Ogle to invest millions. This move is noteworthy as it highlights the growing confidence in Avalanche's potential, especially among corporate treasuries, which could lead to increased adoption and stability in the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System