Texas lawmaker behind state’s crypto reserve bill: Ether may be next

NeutralCryptocurrency

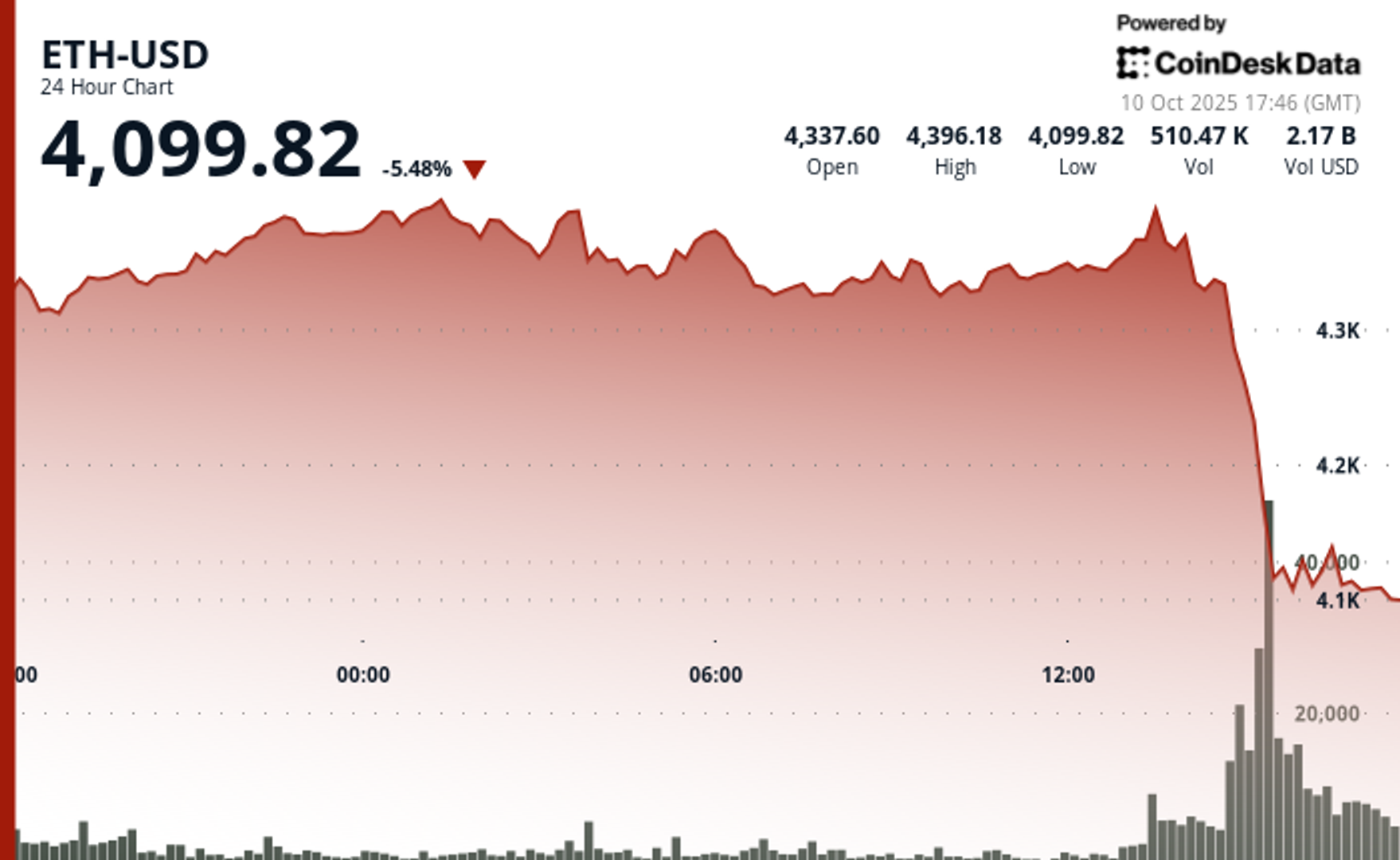

A Texas lawmaker is making headlines with a new bill aimed at establishing a state crypto reserve, which could potentially include Ether as the next asset. This development is significant as it reflects the growing acceptance and integration of cryptocurrencies into state financial systems, although recent price fluctuations have raised concerns about meeting the necessary requirements. As the market evolves, this initiative could pave the way for more states to consider similar measures, highlighting the ongoing shift in how cryptocurrencies are perceived and utilized.

— Curated by the World Pulse Now AI Editorial System