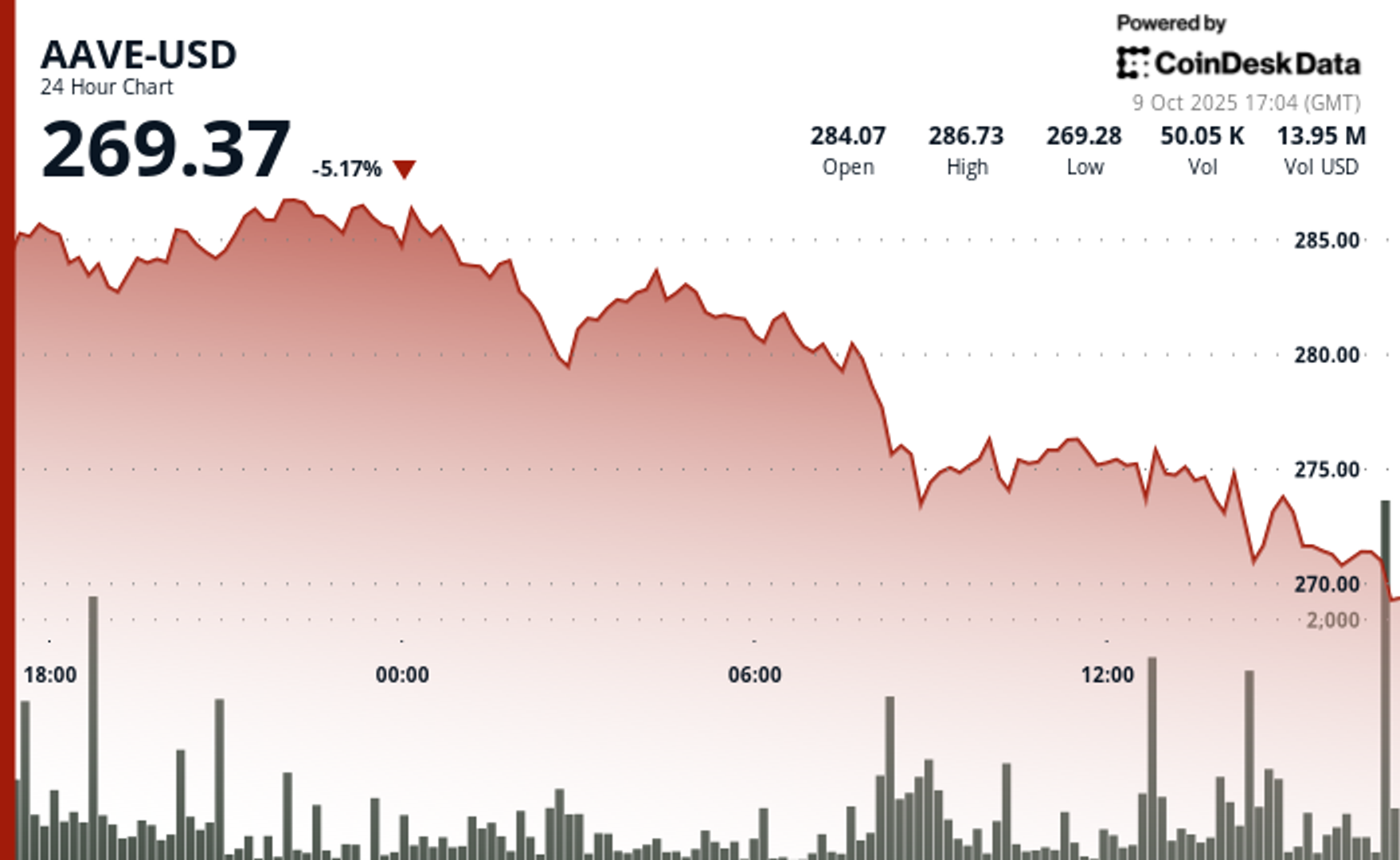

AAVE Plunges Below Key Support Levels Amid Broader Crypto Weakness

NegativeCryptocurrency

AAVE, a leading DeFi token, has recently fallen below crucial support levels due to significant selling pressure, reflecting broader weaknesses in the cryptocurrency market. This decline is concerning for investors as it indicates potential instability in the DeFi sector and raises questions about the future performance of similar tokens.

— via World Pulse Now AI Editorial System