Bitcoin’s strongest trading day since May cues possible rally to $107K

PositiveCryptocurrency

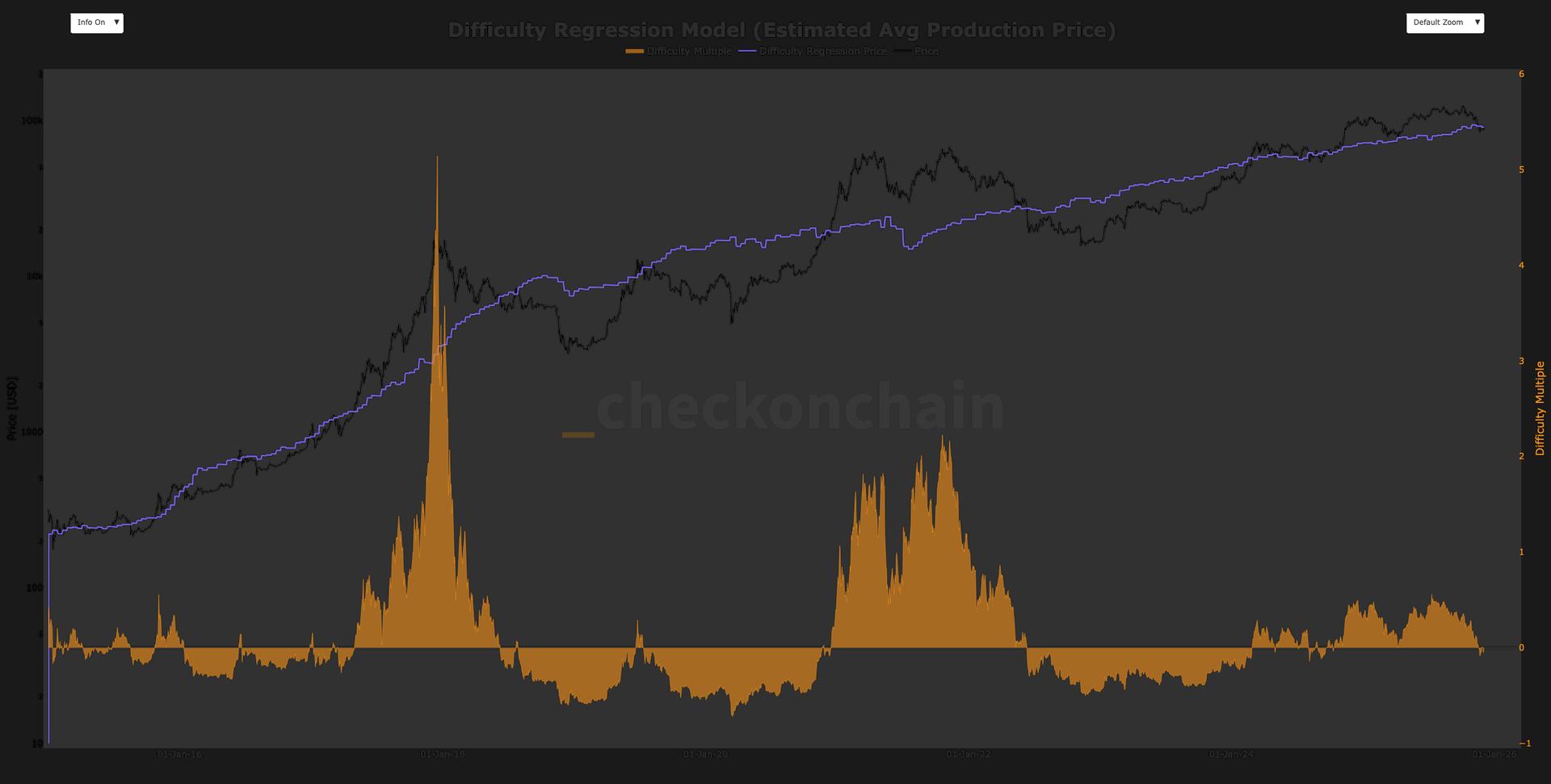

- Bitcoin experienced its strongest trading day since May, with significant buy-side flows and a positive shift in investor sentiment, suggesting a potential rally that could push prices above $100,000. The Coinbase premium has also turned positive, indicating renewed demand in the market.

- This development is crucial for Bitcoin as it reflects a recovery in market dynamics, particularly among U.S. institutions willing to pay above global prices for Bitcoin, which could enhance overall market confidence and attract further investment.

- The recent price surge, alongside the positive Coinbase premium, highlights a broader trend of increasing institutional interest in Bitcoin, suggesting a potential shift in market sentiment that may lead to sustained upward momentum as analysts predict a push towards the $100,000 mark.

— via World Pulse Now AI Editorial System