$19B market crash paves way for Bitcoin’s rise to $200K: Standard Chartered

PositiveCryptocurrency

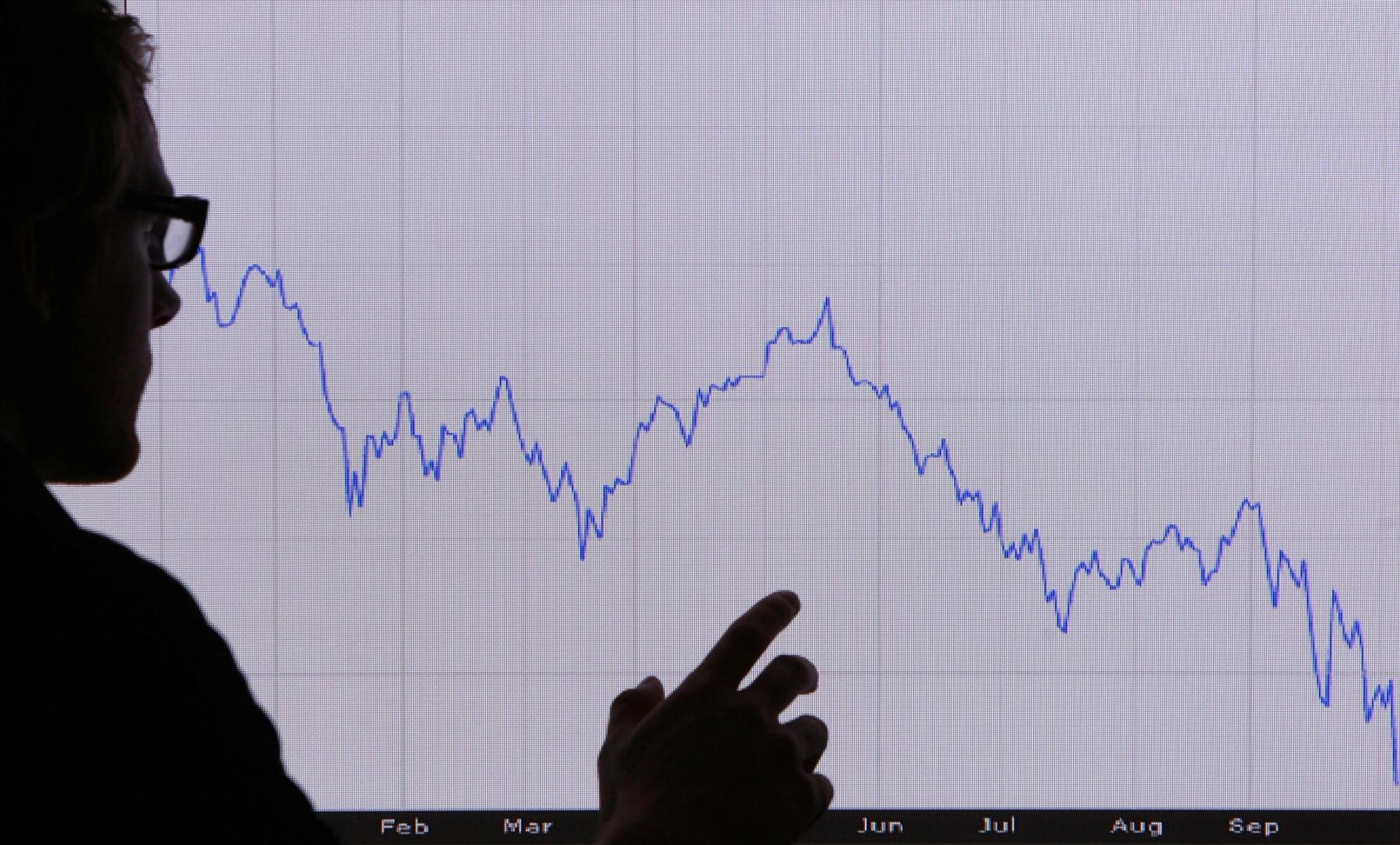

Standard Chartered's Geoff Kendrick suggests that the recent $19 billion market crash could actually present a buying opportunity for Bitcoin, potentially driving its price up to $200,000. This insight is significant as it highlights the resilience of cryptocurrencies in volatile markets and could encourage investors to consider Bitcoin as a viable asset in the wake of market fluctuations.

— Curated by the World Pulse Now AI Editorial System