Ark Invest Signals Liquidity Revival Ahead of Potential Year-End Market Bounce

PositiveCryptocurrency

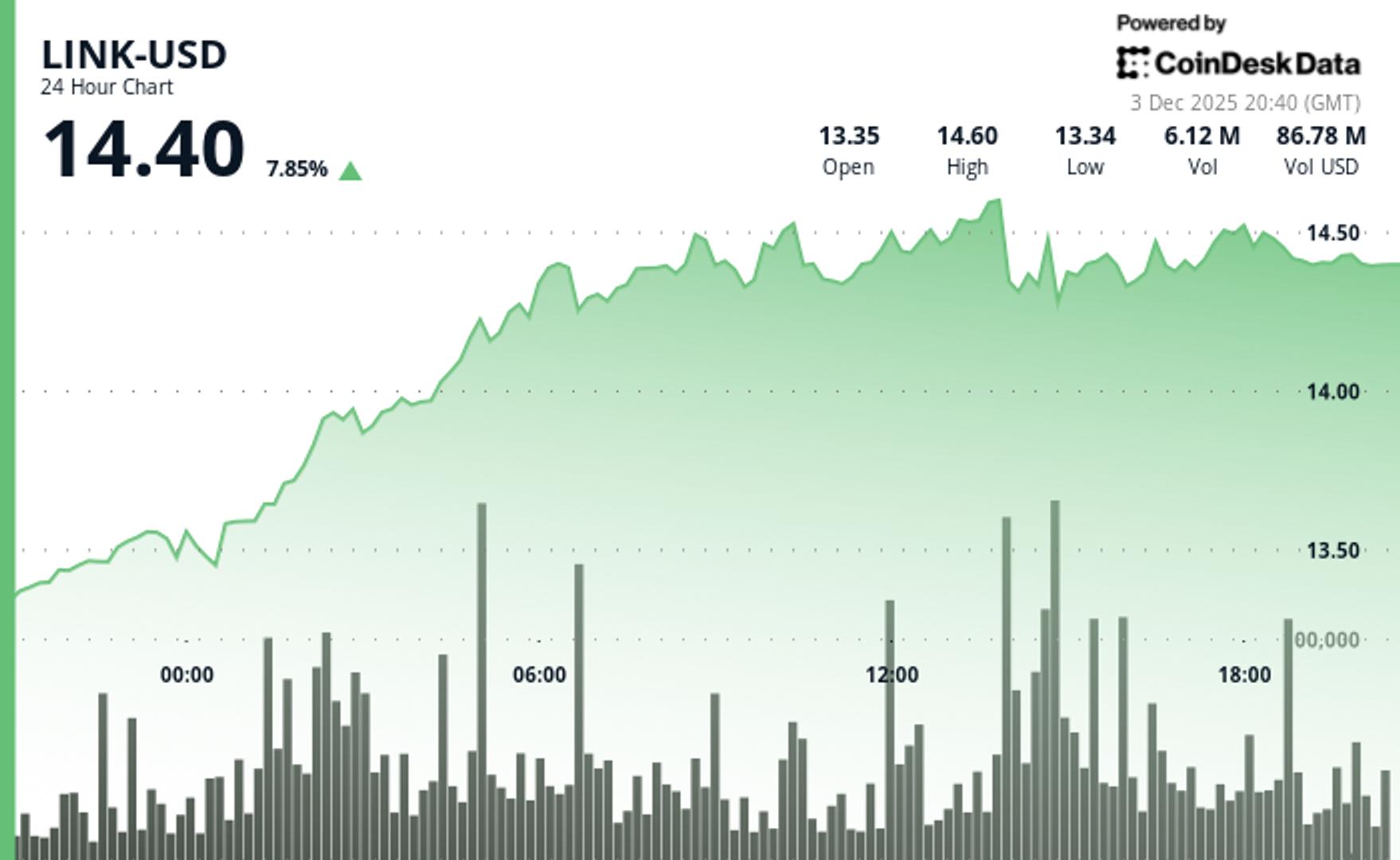

- U.S. market liquidity is showing early signs of recovery following a significant six-week contraction, as indicated by Ark Invest's recent activities and market analysis. This revival may signal a potential year-end market bounce, particularly in the cryptocurrency sector.

- The recovery in liquidity is crucial for Ark Invest, as it reflects a renewed investor confidence that could enhance the performance of its cryptocurrency investments. The firm has been actively purchasing stocks in major crypto companies, indicating a strategic positioning for future gains.

- This development occurs against a backdrop of increasing optimism among Bitcoin investors, driven by the likelihood of a Federal Reserve rate cut in December, which could stabilize Bitcoin prices. Additionally, market participants are closely monitoring the Fed's policy decisions, which are expected to influence overall market dynamics and investor sentiment.

— via World Pulse Now AI Editorial System