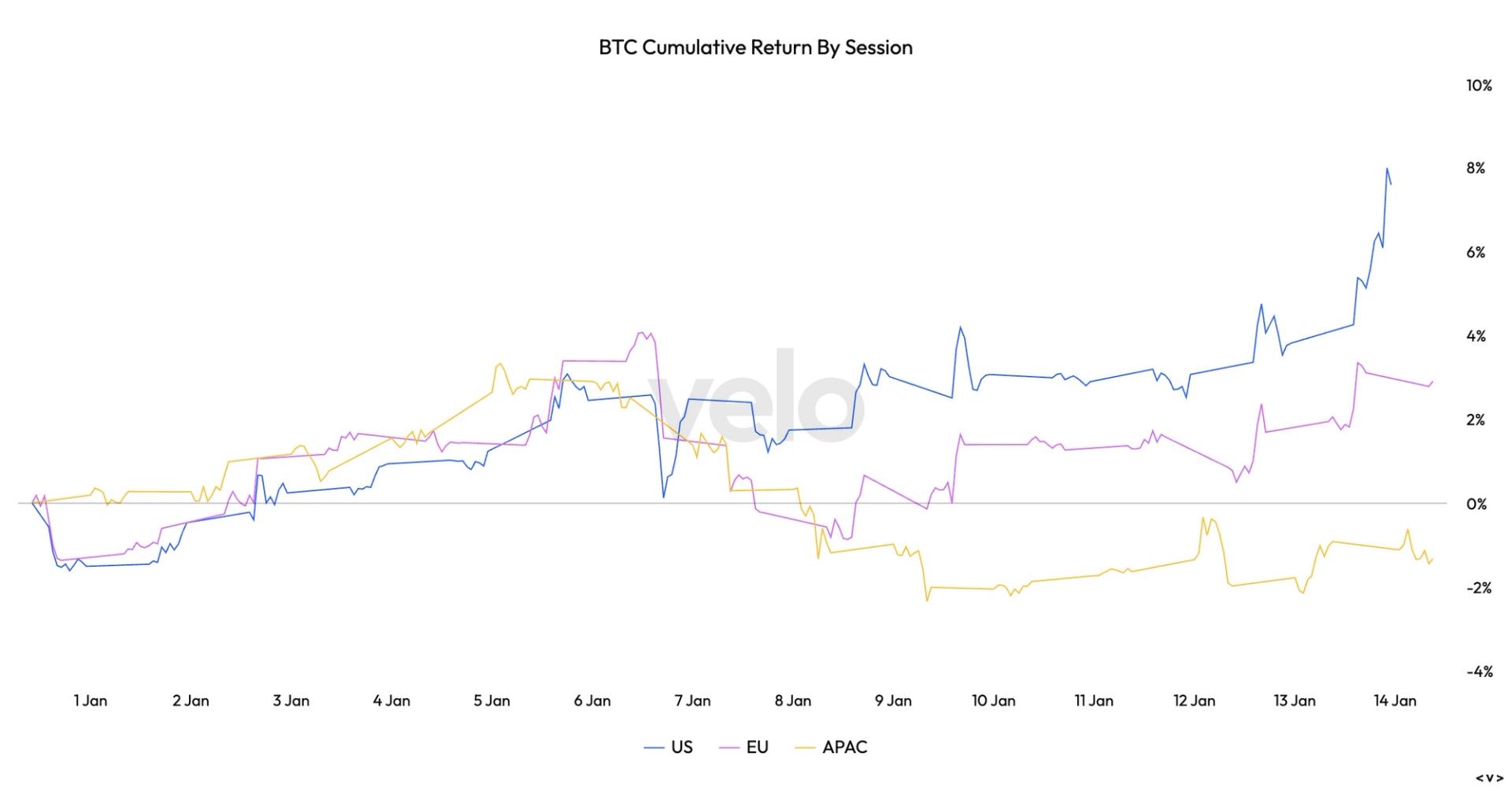

Bull or bear market? Traders panic as Bitcoin dips below 365-day average

NegativeCryptocurrency

Bitcoin has recently dipped below its 365-day moving average, causing traders to panic and raising questions about whether this indicates the start of a bear market or just a temporary setback. This situation is significant as it reflects the volatility of cryptocurrency markets and the uncertainty that can impact investor confidence.

— via World Pulse Now AI Editorial System