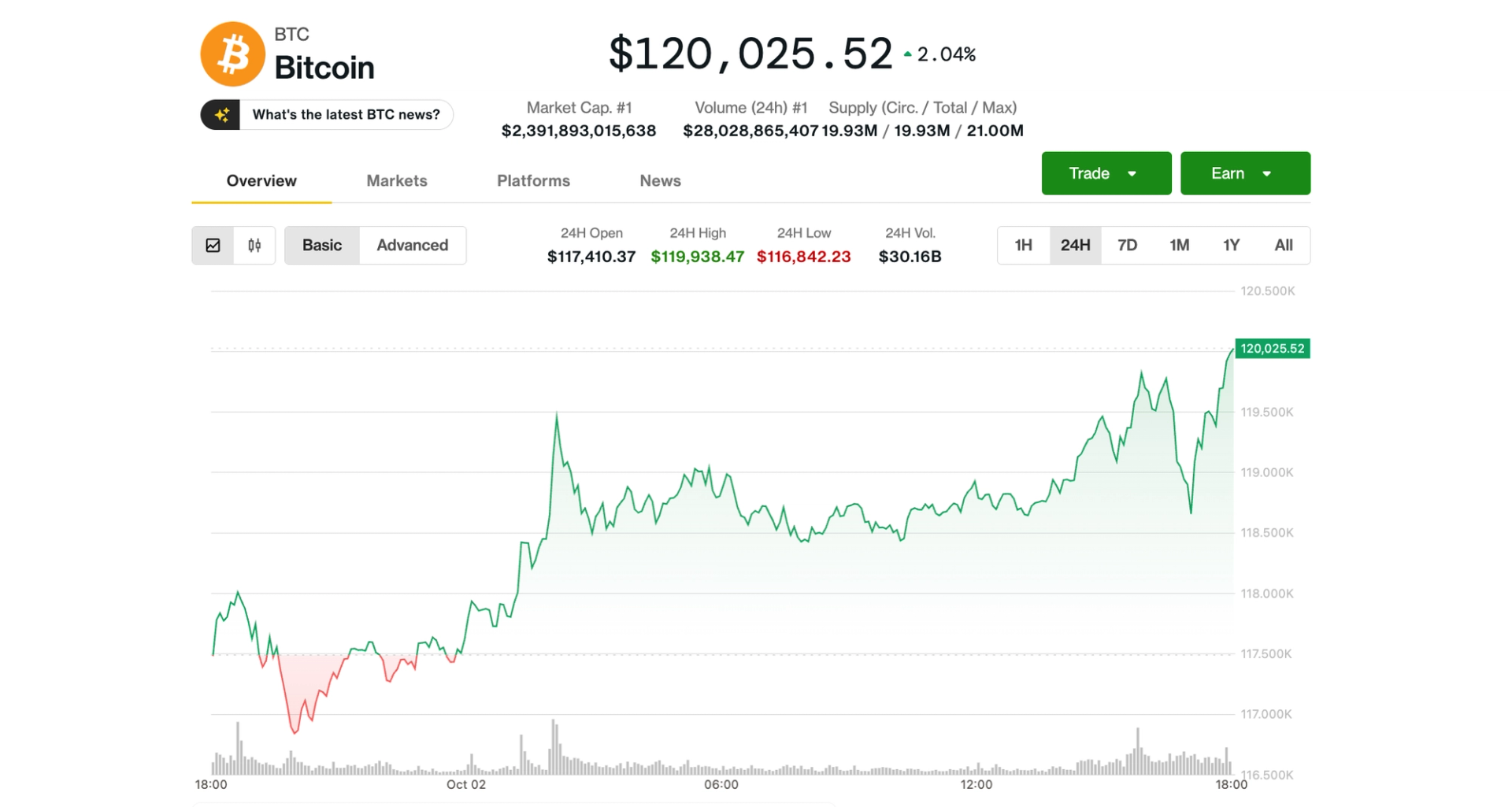

Bitcoin Hits $120K With Traders Eyeing Bullish October Rally

PositiveCryptocurrency

Bitcoin has reached an impressive milestone of $120,000, sparking excitement among traders who are optimistic about a bullish rally this October. This surge not only reflects growing confidence in the cryptocurrency market but also indicates potential investment opportunities for those looking to capitalize on the upward trend. As more investors enter the space, the implications for the broader financial landscape could be significant, making it a crucial moment for both seasoned and new traders.

— Curated by the World Pulse Now AI Editorial System