Dogecoin Market Cap Tests Multi-Year Ceiling, Long-Term Momentum Still Intact

PositiveCryptocurrency

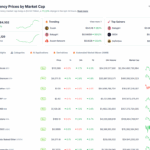

Dogecoin is showing promising signs as its market cap approaches a multi-year ceiling, with analysts noting a potential cup-and-handle breakout. This technical analysis suggests that Dogecoin's momentum remains strong, hovering just under $30 billion and above its 25-month moving average. This is significant for investors as it indicates a possible upward trend, making Dogecoin an asset to watch in the crypto market.

— Curated by the World Pulse Now AI Editorial System