Ethereum Crashes Below $3K as Liquidations Spike and Volatility Looms

NegativeCryptocurrency

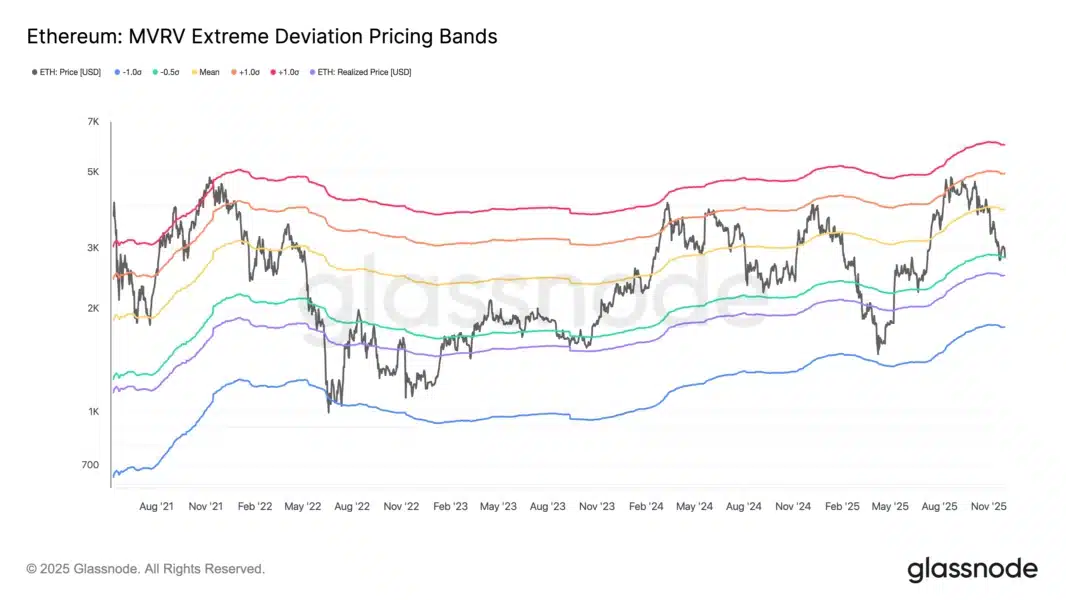

- Ethereum's price has fallen below the critical $3,000 mark, trading around $2,900 to $2,950 after a significant sell-off. This decline has resulted in a 5-7% drop over 24 hours, with liquidations of long positions exceeding $670 million, highlighting the volatility in the cryptocurrency market.

- The breach of the $3,000 psychological support level raises concerns about potential capitulation among investors, as bearish trends persist and market engagement wanes, evidenced by a 32% drop in active addresses.

- This downturn reflects broader market challenges, including a 51% reduction in Ethereum's open interest and a notable decline in trading activity, indicating a potential reset in market dynamics as investors navigate ongoing volatility.

— via World Pulse Now AI Editorial System