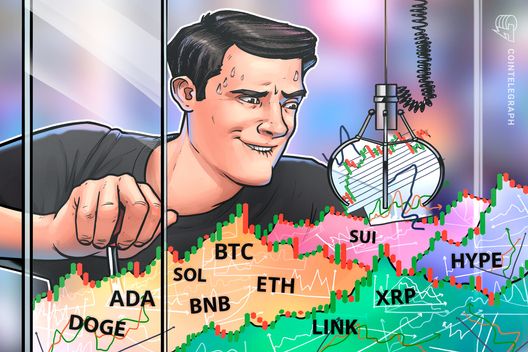

‘Distribution Is the Key’: BNB’s 129% Rally Mirrors Solana’s 2024 Surge

PositiveCryptocurrency

BNB's impressive 129% rally is capturing attention, largely attributed to Binance's vast scale and user engagement, which saw $14.8 billion in inflows last quarter. This surge not only highlights the growing confidence in BNB but also mirrors the momentum seen with Solana in 2024, suggesting a robust recovery and interest in the cryptocurrency market. Such developments are crucial as they indicate a potential shift in investor sentiment and could pave the way for further growth in the sector.

— Curated by the World Pulse Now AI Editorial System