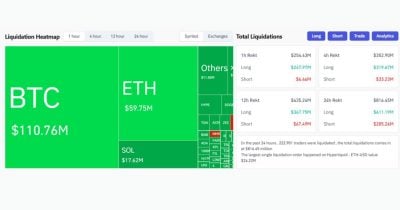

Bitcoin suddenly drops below $87,500, triggering over $250 million liquidation

NegativeCryptocurrency

- Bitcoin's recent drop below $87,500 has triggered significant liquidations, highlighting the inherent volatility in cryptocurrency markets.

- This decline raises concerns among investors regarding market stability and the potential for further downturns, particularly as institutional selling increases.

- The current market environment reflects a broader trend of fear and uncertainty, with many traders cautious amid declining prices and significant sell-offs, indicating a potential shift towards a bear market.

— via World Pulse Now AI Editorial System