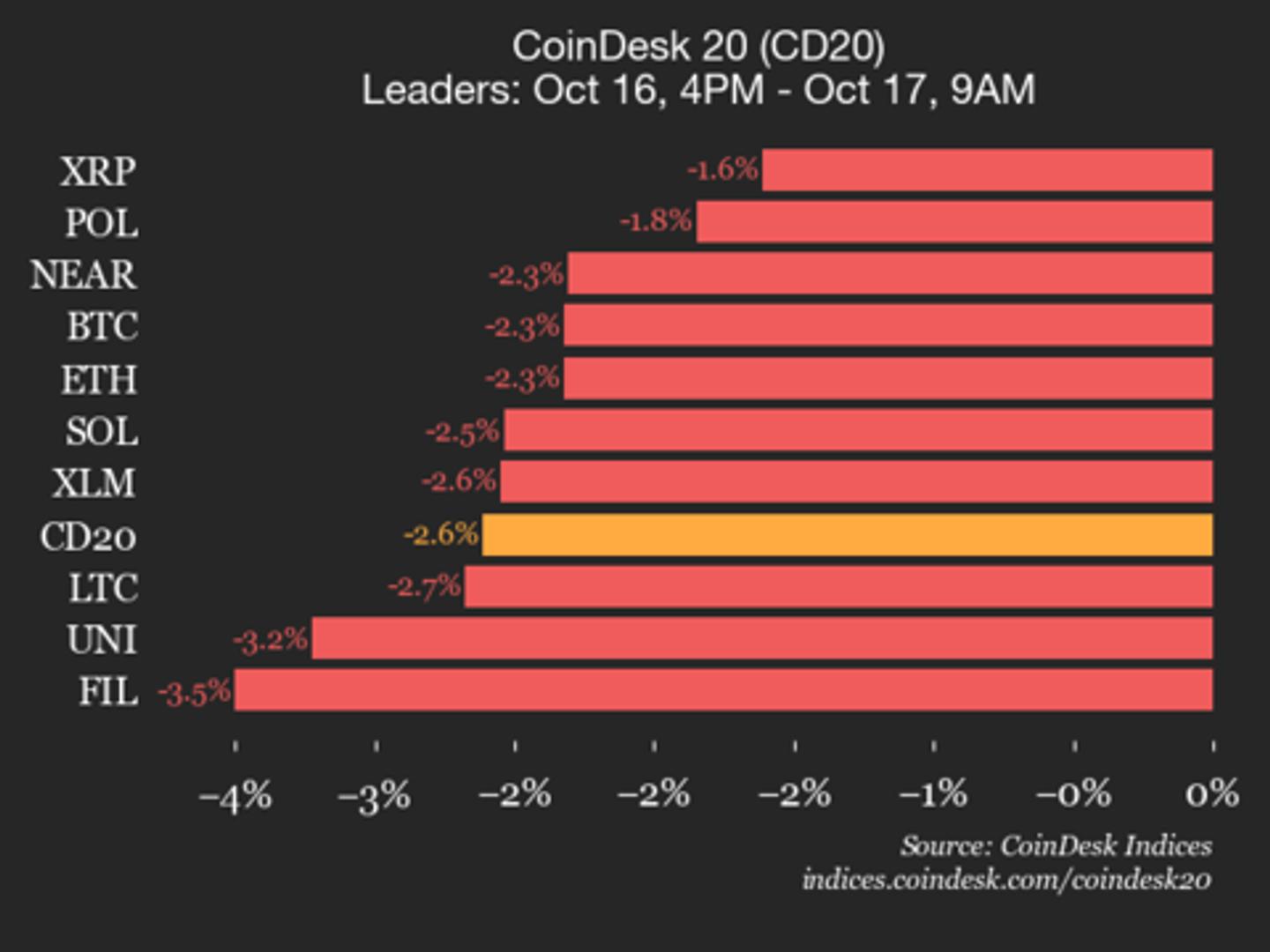

CoinDesk 20 Performance Update: Index Falls 2.6% as All Constituents Trade Lower

NegativeCryptocurrency

The CoinDesk 20 index has seen a decline of 2.6%, primarily driven by significant drops in major cryptocurrencies like Aave, which fell by 10.1%, and Bitcoin Cash, down by 8.7%. This downturn is noteworthy as it reflects broader market trends and investor sentiment, raising concerns about the stability of the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System