ICP Rises as Cross-Chain Narratives Gain Attention

PositiveCryptocurrency

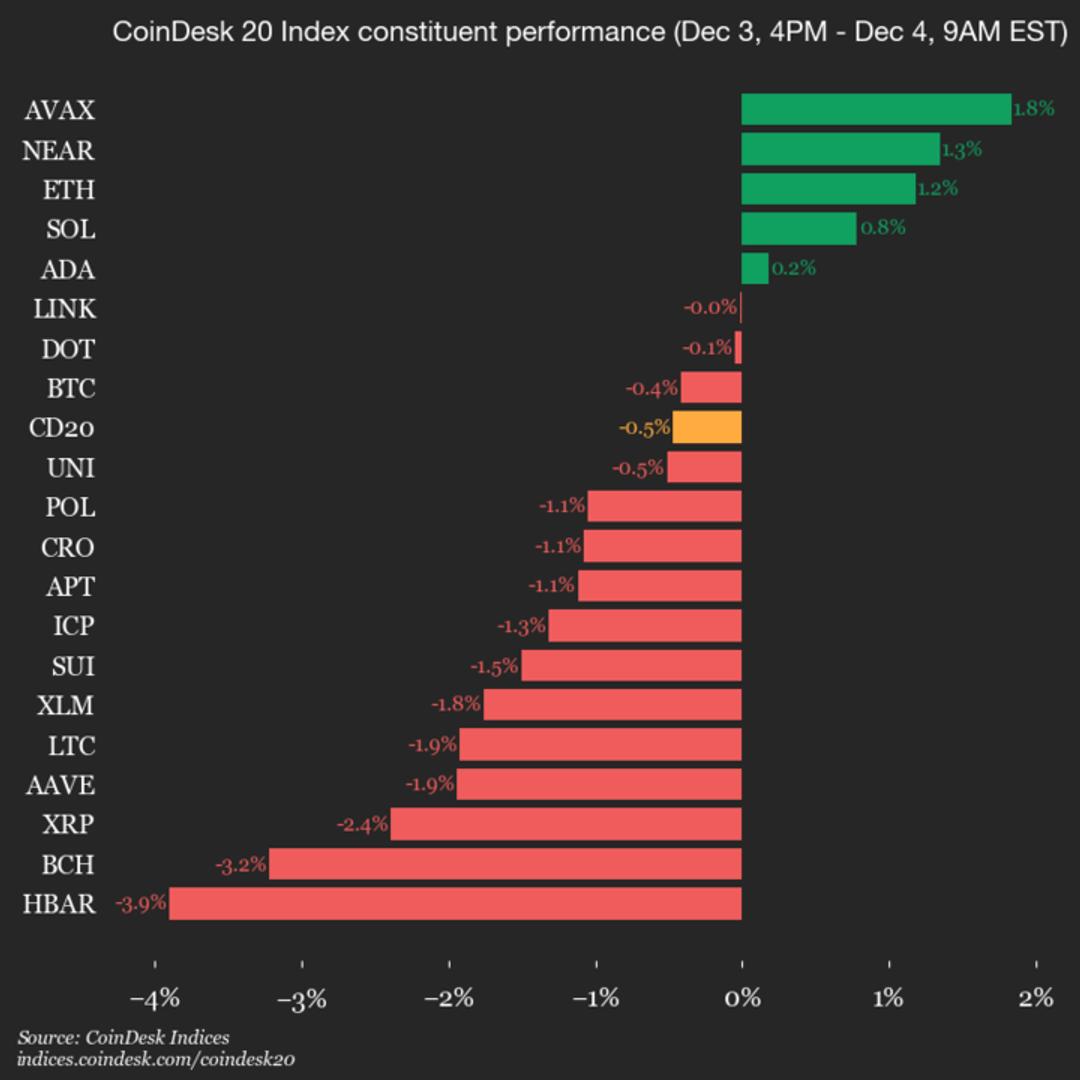

- Internet Computer (ICP) has experienced a rise as broader market consolidation has kept its price action within key support and resistance levels, indicating a potential upward trend. This movement aligns with a growing interest in cross-chain narratives within the cryptocurrency sector.

- The increase in ICP's value is significant as it suggests a strengthening position for the Internet Computer platform, which aims to enhance decentralized applications and services. This upward momentum may attract further investment and user engagement.

- The cryptocurrency market is currently witnessing a rebound, with various altcoins, including Filecoin and Stellar, showing positive price movements. This trend reflects a broader recovery in market sentiment, as Bitcoin also reclaims significant price levels, indicating a potential shift in investor confidence after a period of volatility.

— via World Pulse Now AI Editorial System