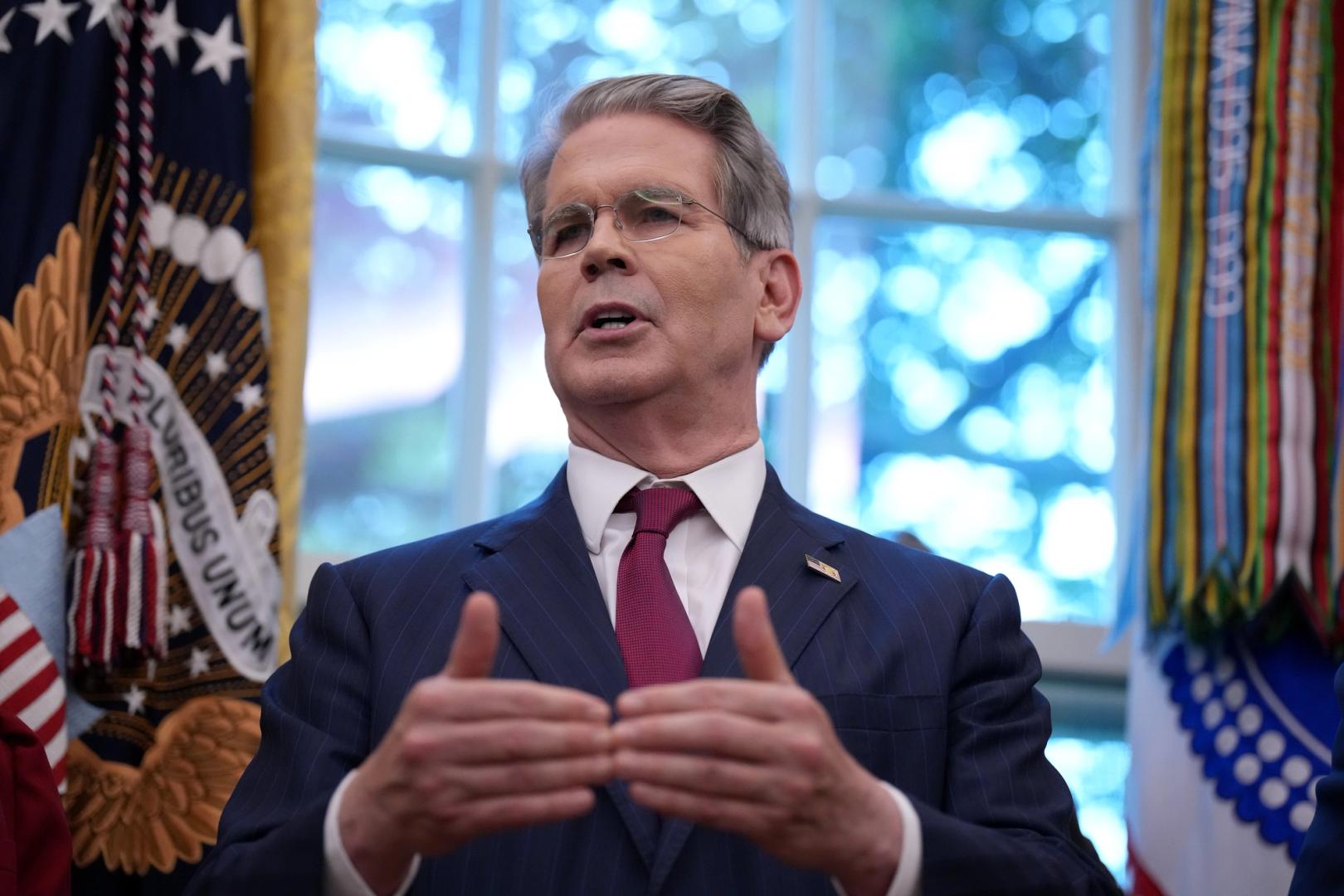

Steak ‘n Shake creates strategic Bitcoin reserve

PositiveCryptocurrency

Steak 'n Shake's recent decision to create a strategic Bitcoin reserve marks a significant step in the corporate adoption of digital assets. This move not only showcases the restaurant chain's innovative approach but also has the potential to influence broader industry trends as more companies consider integrating cryptocurrencies into their financial strategies.

— Curated by the World Pulse Now AI Editorial System