Bitcoin traders hit peak unrealized pain as ETFs start to turn positive

NegativeCryptocurrency

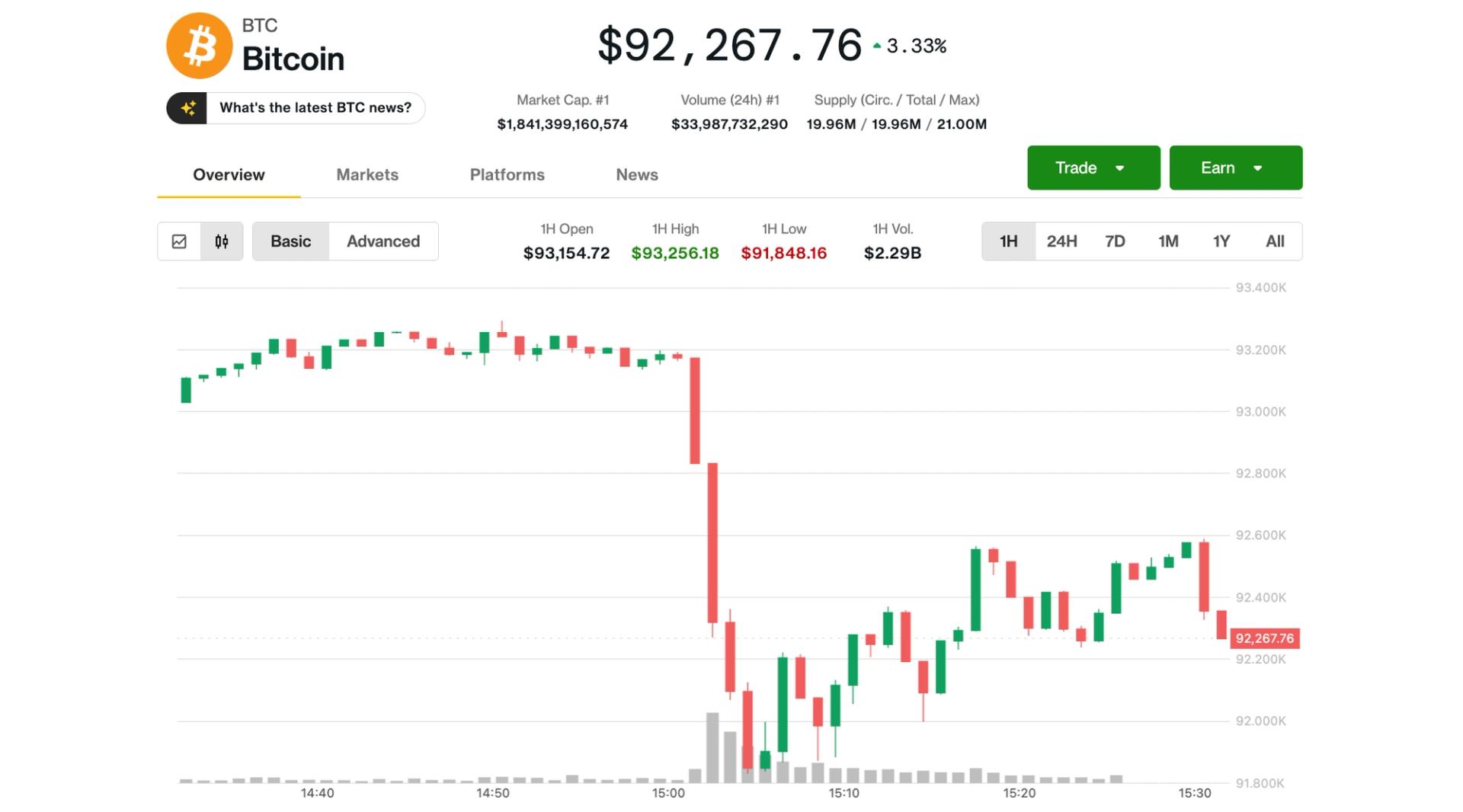

- Bitcoin traders are currently experiencing significant unrealized losses, marking a peak in pressure during this cycle. Analysts suggest that the recent selling pressure is only partially attributed to exchange-traded funds (ETFs), which accounted for a maximum of 3% of the decline.

- This situation is critical for Bitcoin traders as it reflects the broader market sentiment and the challenges faced in recovering from losses. The pressure on traders may influence their trading strategies and market behavior in the near term.

- The cryptocurrency market is witnessing fluctuating sentiments, with some indicators showing a shift from extreme fear to a more optimistic outlook. Despite Bitcoin's struggles to break key price resistance levels, recent inflows into Bitcoin ETFs suggest a potential stabilization in institutional demand, contrasting with the overall market volatility.

— via World Pulse Now AI Editorial System