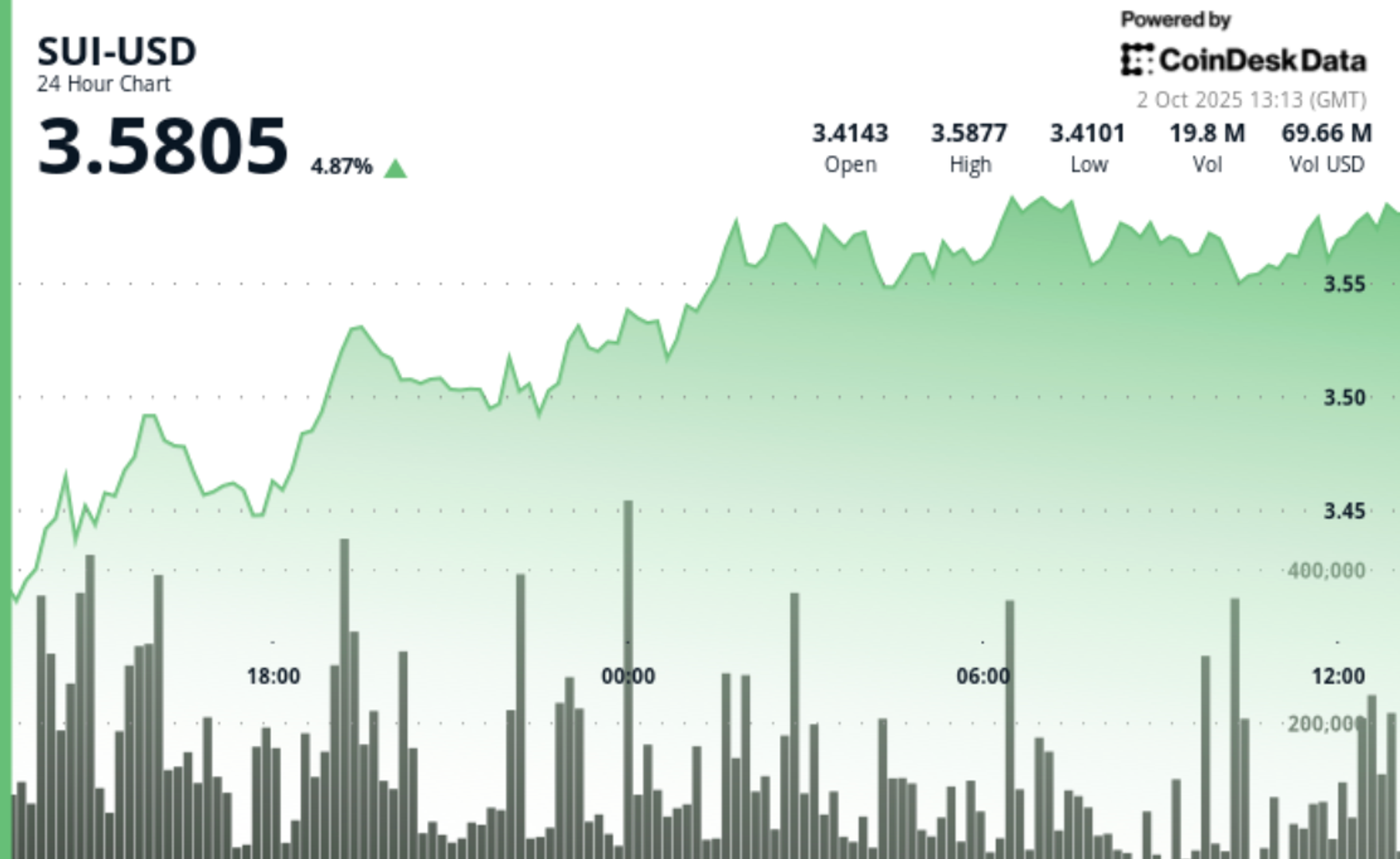

SUI Jumps 5% as Sui Blockchain Announces Native Stablecoins Amid Broader Rally

PositiveCryptocurrency

SUI has surged by 5% following the announcement of native stablecoins by the Sui Blockchain, reflecting a broader rally in the market. This development is significant as it indicates strong buying momentum, particularly driven by institutional interest, which could lead to increased stability and confidence in the blockchain ecosystem.

— Curated by the World Pulse Now AI Editorial System