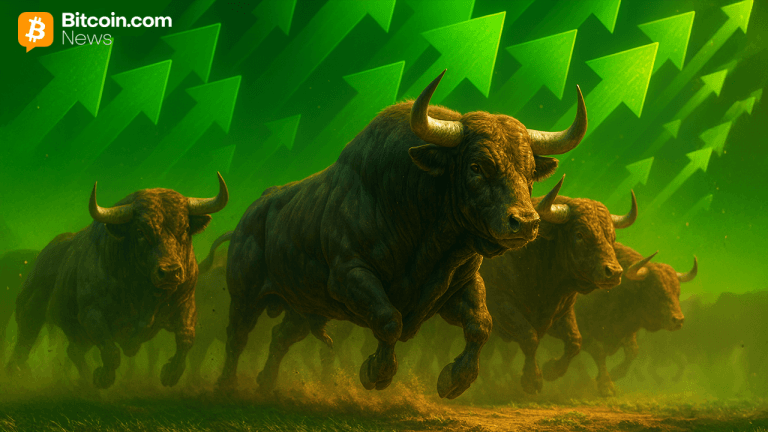

Bitcoin price could hit $231k, a major Wall Street bank predicts

PositiveCryptocurrency

Bitcoin is on a strong recovery path, nearing a significant resistance level of $120,000, with a notable increase of over 10% since its September lows. A major Wall Street bank, Citi, has predicted that Bitcoin's price could soar to $232,000. This optimistic forecast is important as it reflects growing confidence in the cryptocurrency market, potentially attracting more investors and influencing market dynamics.

— Curated by the World Pulse Now AI Editorial System