Sharplink Hits Near $1Bn in Paper Gains: How Liquid Are SBET ETH Profits?

PositiveCryptocurrency

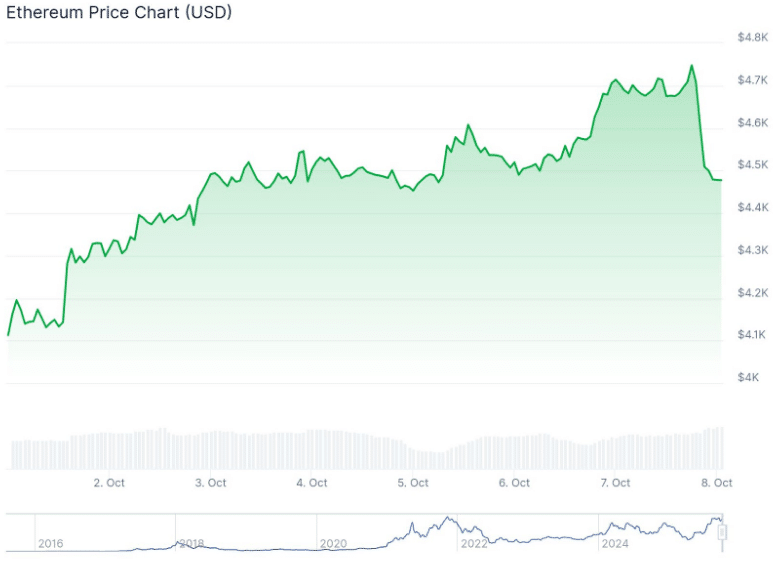

SharpLink Gaming has seen its Ethereum portfolio surge in value, nearing $1 billion in unrealized profits after a recent 4.5% rise in cryptocurrency prices. Since starting to accumulate Ether on June 2, the company's gains have exceeded $900 million. This significant increase not only highlights the potential profitability of investing in cryptocurrencies but also raises questions about the liquidity of these profits and how they can be realized in the market.

— Curated by the World Pulse Now AI Editorial System