$540M crypto market crash: Here’s why altcoins are down

NegativeCryptocurrency

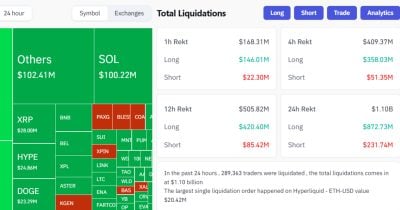

The recent crypto market crash has led to a staggering loss of $540 million, significantly impacting smaller altcoins. On October 16, the overall market cap fell sharply, raising concerns among investors and traders. This downturn is crucial as it highlights the volatility of the crypto market and the risks associated with investing in altcoins, which are often more susceptible to market fluctuations. Understanding these dynamics is essential for anyone involved in cryptocurrency.

— Curated by the World Pulse Now AI Editorial System

![[LIVE] Crypto News Today, October 17 – After Trump’s Speech, Crypto Market Crashes Further: Gold Price Hits ATH, Bitcoin Falls to $104K, ETH Below $3.7K — Is This the Best Crypto to Buy Opportunity?](https://dummyimage.com/600x400/1a4a3b/ffffff.png&text=World Pulse Now)