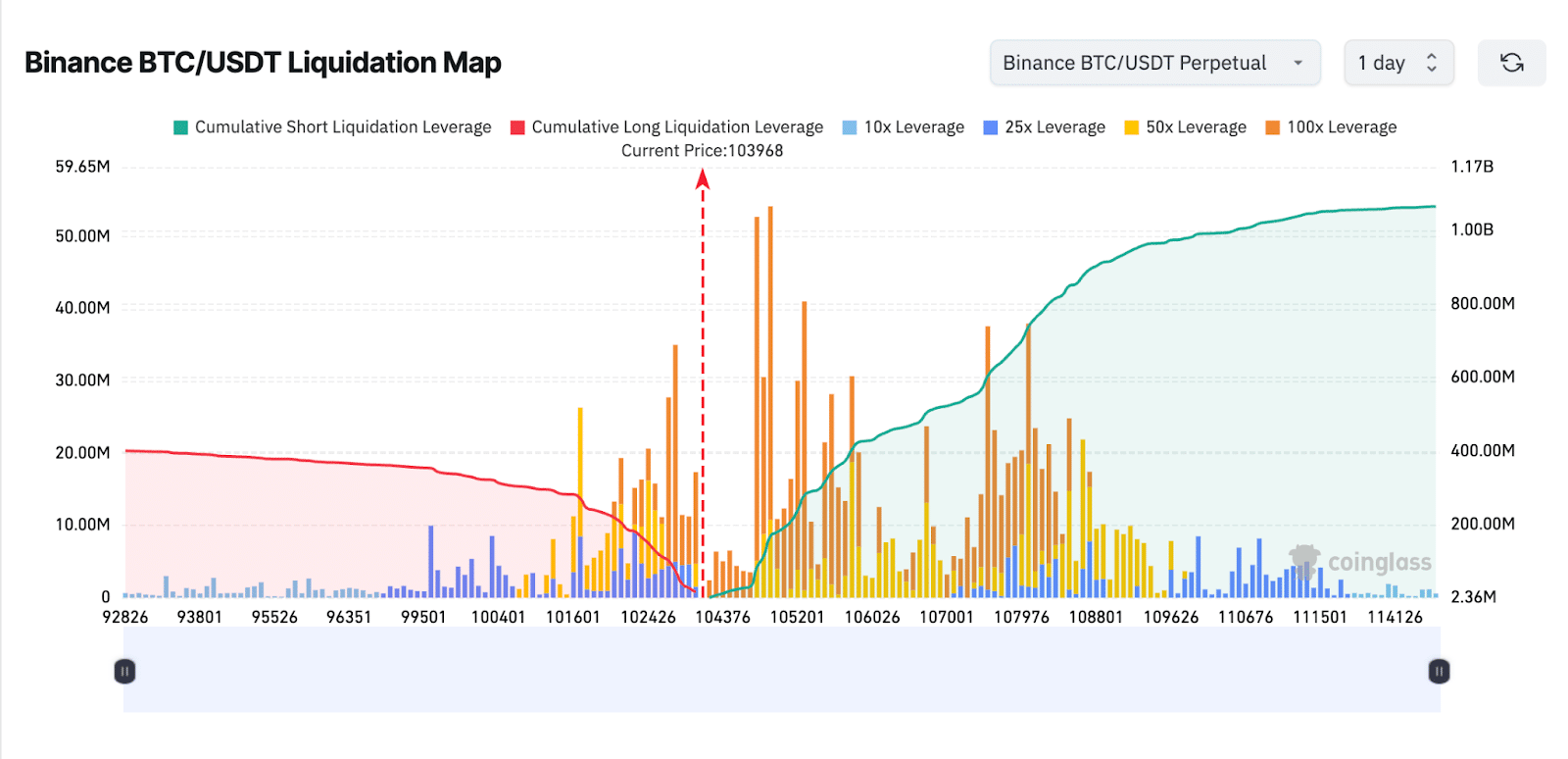

Bitcoin Mining Profitability Slumps as Hashprice Falls to Multi-Month Low

NegativeCryptocurrency

Bitcoin mining profitability has taken a significant hit as hashprice has dropped to a multi-month low. This decline is crucial for miners who rely on favorable conditions to sustain their operations and profitability. As the market fluctuates, this downturn could lead to increased challenges for miners, potentially impacting the overall cryptocurrency ecosystem.

— Curated by the World Pulse Now AI Editorial System