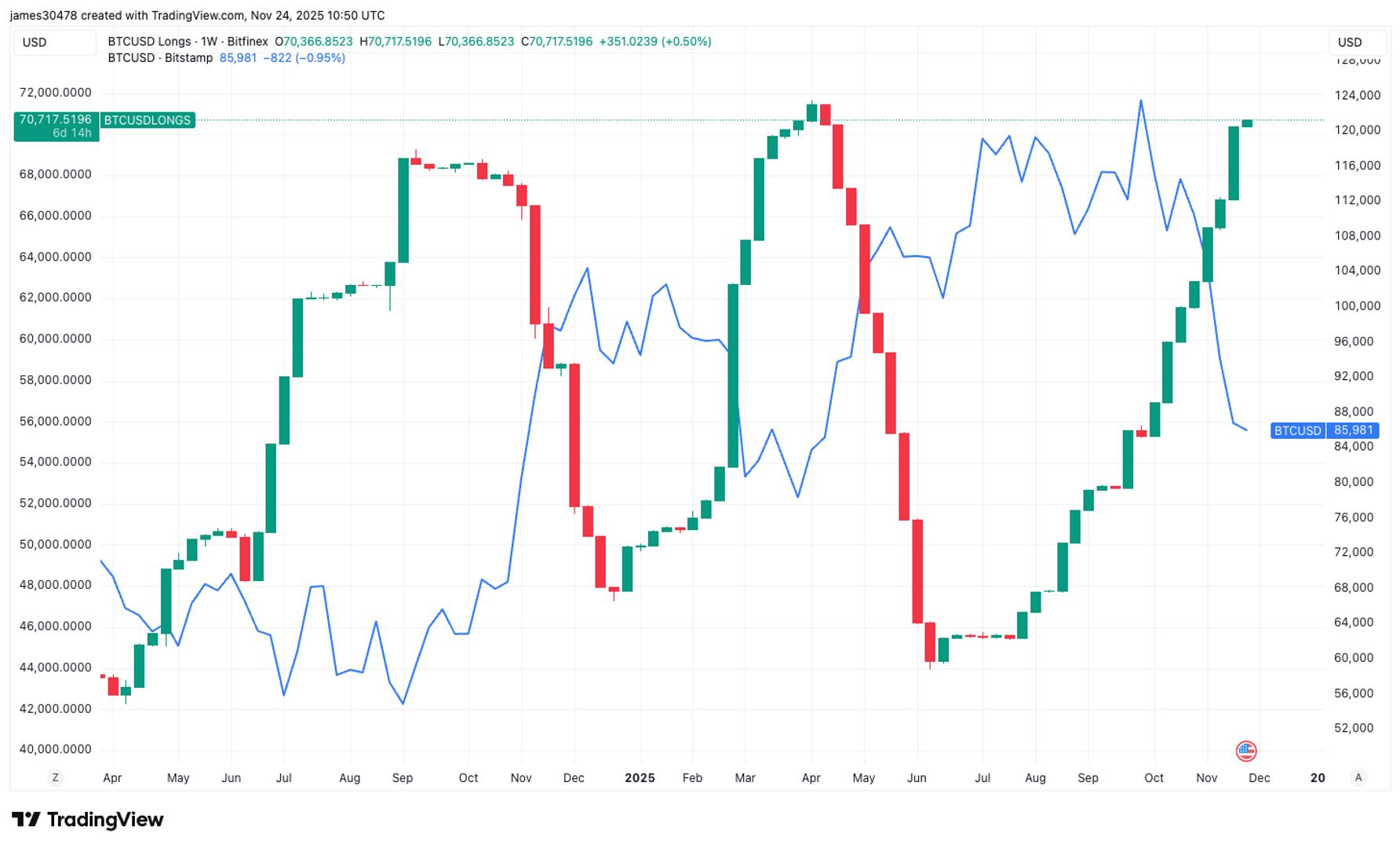

Bitcoin Longs on Bitfinex Jump 40% in Three Months as Traders Double Down on Dip

PositiveCryptocurrency

- Bitcoin longs on Bitfinex have surged by 40% over the past three months as traders capitalize on recent price dips, indicating a growing confidence among investors despite market volatility. This increase in long positions suggests that traders are betting on a recovery after Bitcoin's price stabilized above $86,000 following a significant inflow of $2 billion into exchanges for profit-taking.

- The rise in long positions on Bitfinex reflects a strategic move by traders to leverage the current market conditions, which have been marked by fluctuations and profit-taking activities. This trend indicates a potential shift in market sentiment as traders look to benefit from anticipated price rebounds.

- The broader cryptocurrency market is currently experiencing mixed signals, with the Bitcoin Greed & Fear Index showing extreme pessimism and realized losses reaching levels reminiscent of the FTX crash. Despite these challenges, some analysts suggest that the decline in open interest could signal a potential bottom, allowing for renewed bullish trends as investors navigate the complexities of the market.

— via World Pulse Now AI Editorial System