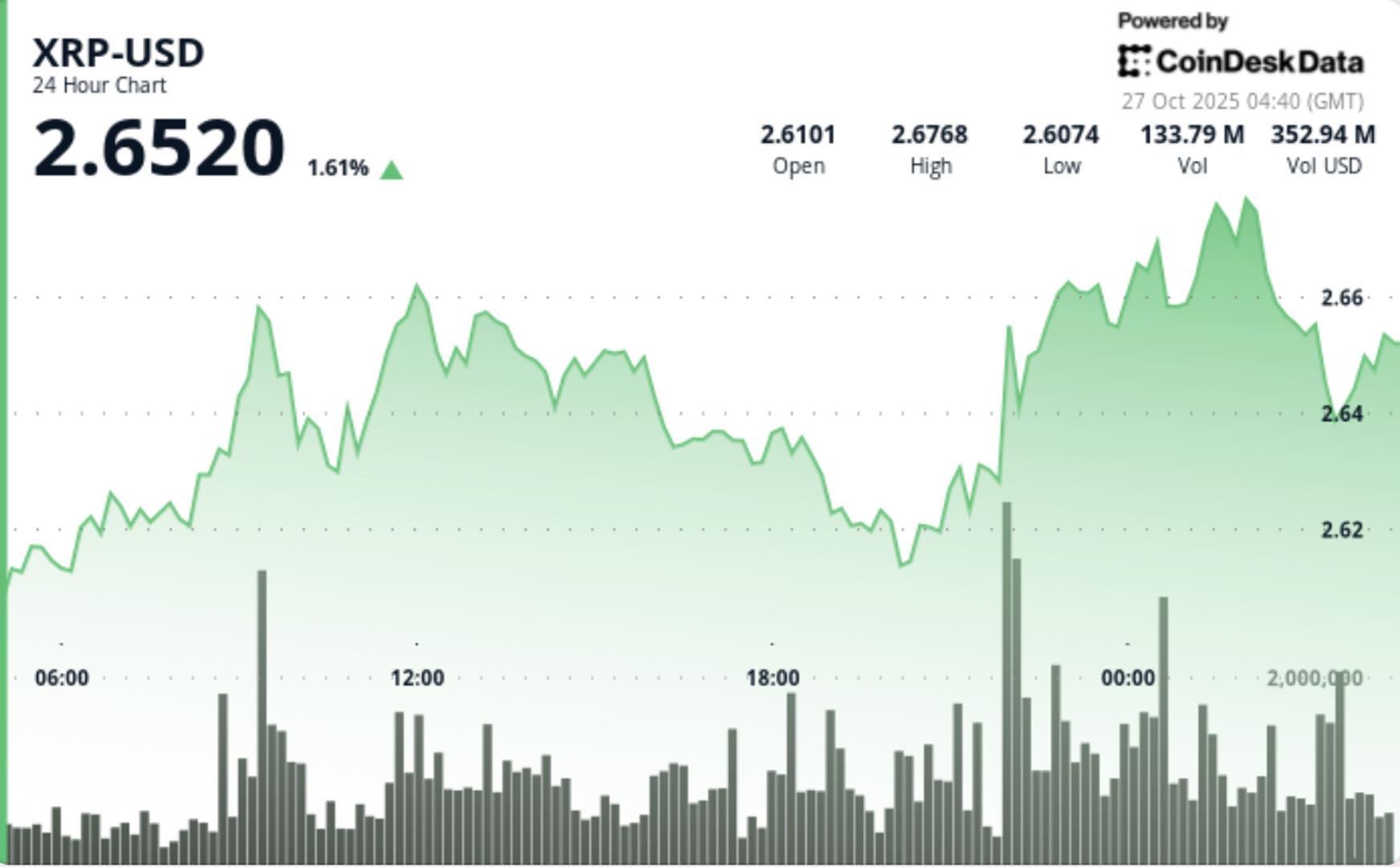

Crypto prices today (Oct. 27): BTC, ETH, XRP, BNB regain strength as market bounces 3.5%

PositiveCryptocurrency

Today, cryptocurrency prices are experiencing a positive surge, with Bitcoin, Ethereum, XRP, and BNB all regaining strength as the market bounces back by 3.5%. This uptick comes as traders react to easing U.S.–China trade tensions and increasing expectations of a Federal Reserve rate cut, which could further boost market confidence. This is significant as it reflects a growing optimism in the crypto market, potentially attracting more investors.

— Curated by the World Pulse Now AI Editorial System