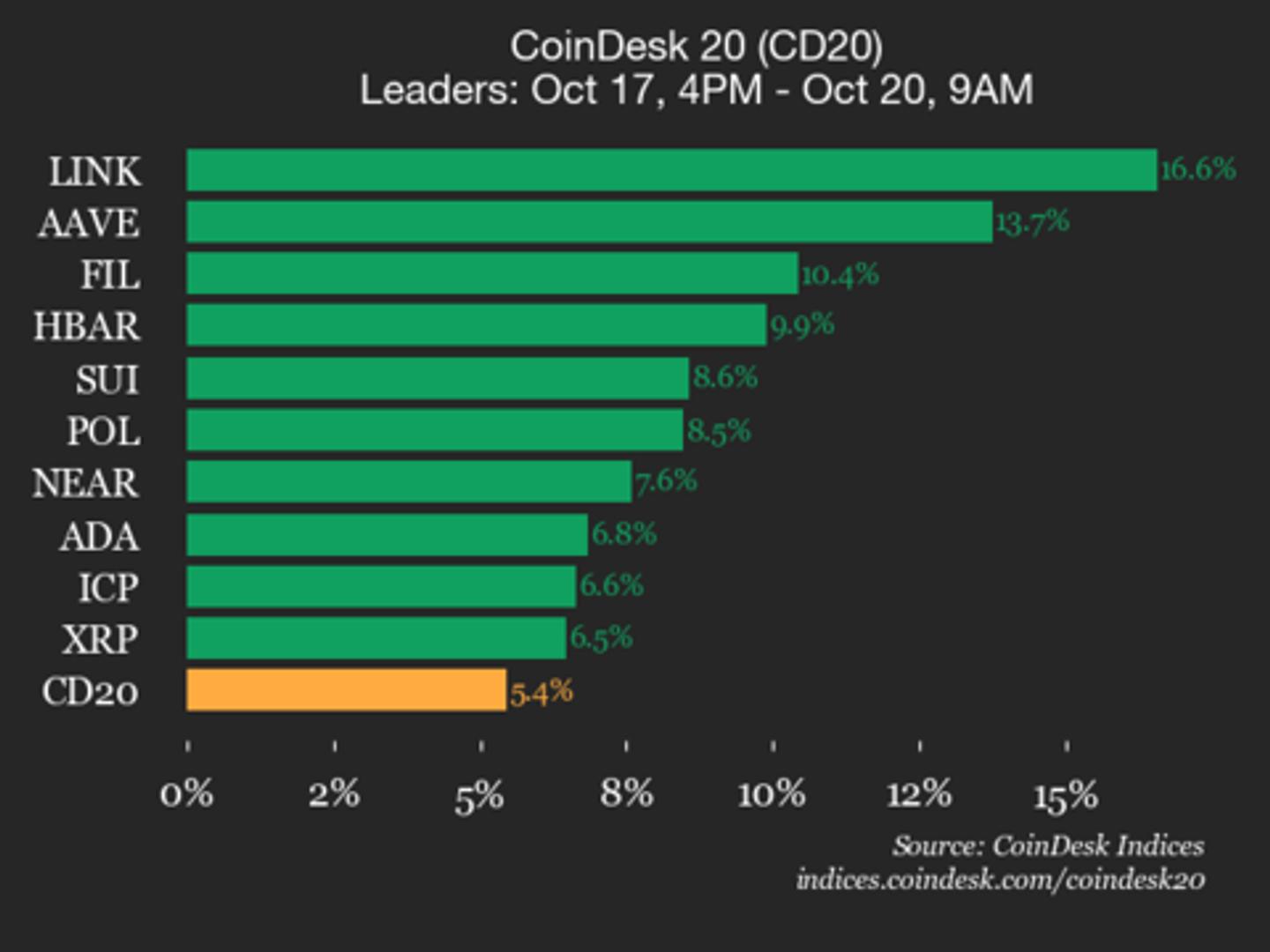

CoinDesk 20 Performance Update: Chainlink (LINK) Surges 16.6%, Leading Index Higher

PositiveCryptocurrency

Chainlink (LINK) has made headlines with a remarkable surge of 16.6%, leading the CoinDesk 20 index higher. This impressive performance not only highlights the growing interest in Chainlink but also reflects the overall positive sentiment in the cryptocurrency market. Investors are keenly watching these developments, as they could signal a broader trend of recovery and growth in digital assets.

— Curated by the World Pulse Now AI Editorial System