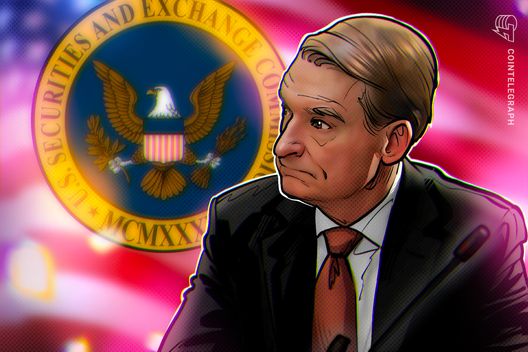

SEC’s ‘future-proofing’ push to shape how much freedom crypto enjoys after Trump

NeutralCryptocurrency

The SEC is taking steps to influence the future of cryptocurrency regulation in the U.S., especially in light of potential changes with upcoming presidential administrations. Legal experts discuss the implications of these regulatory efforts and how they could impact the freedom that cryptocurrencies currently enjoy. This is significant as it highlights the ongoing tension between innovation in the crypto space and the need for regulatory oversight.

— Curated by the World Pulse Now AI Editorial System