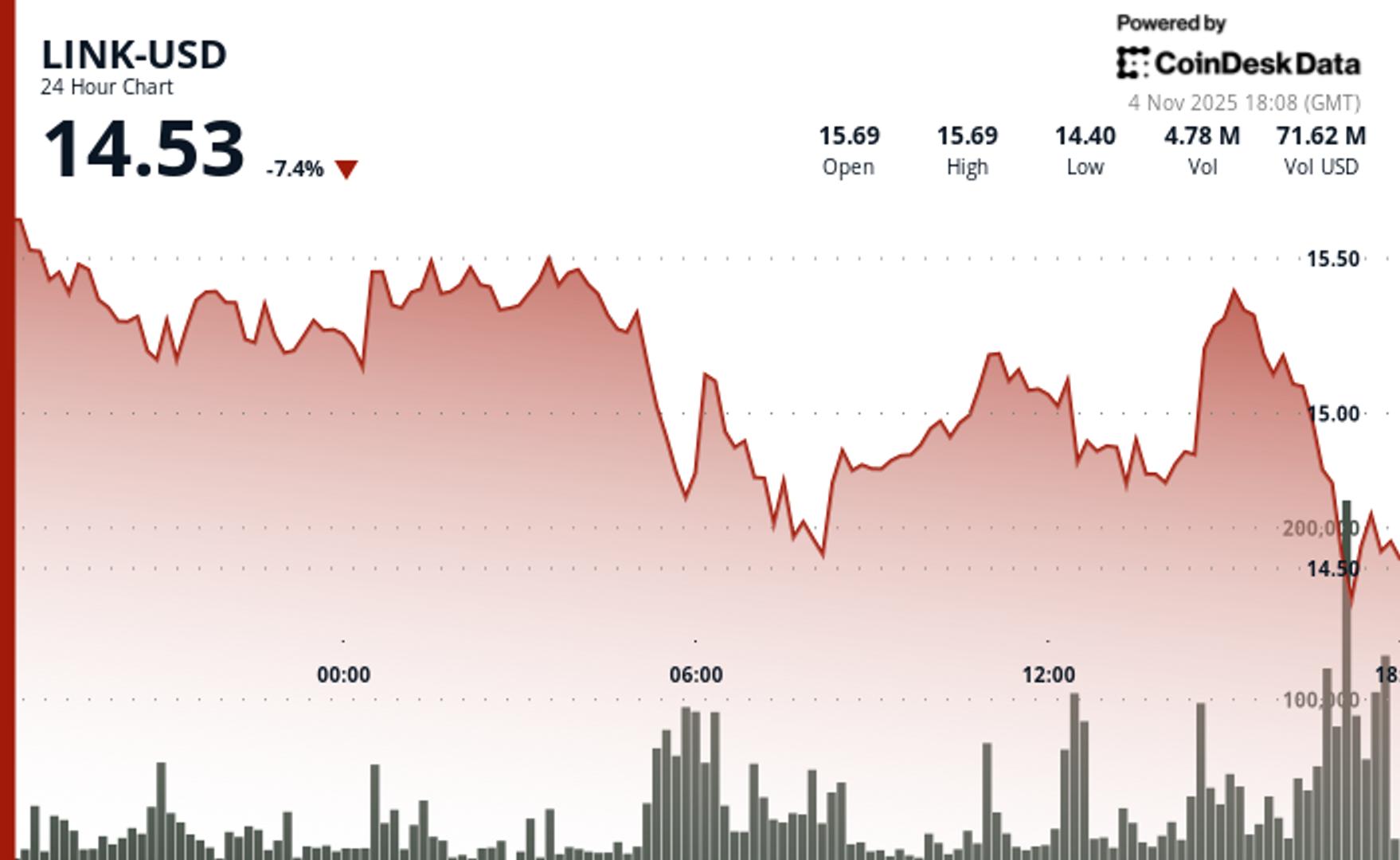

Chainlink's LINK Tumbles 6% as Technical Breakdown Trumps UBS, FTSE Partnership

NegativeCryptocurrency

Chainlink's LINK experienced a 6% decline, driven primarily by a technical breakdown that suggests the possibility of further price decreases. Despite the recent partnership with UBS and FTSE, which might have been expected to bolster confidence, the technical factors have outweighed this positive development. Market analysts predict that LINK's price could fall to $14, reflecting a broader bearish trend affecting the cryptocurrency. This downturn highlights how technical indicators can have a stronger impact on price movements than strategic partnerships in the current market environment. The overall market trend remains negative, contributing to the pressure on LINK's valuation. Consequently, the partnership with UBS and FTSE has not been sufficient to counteract the prevailing technical and market challenges.

— via World Pulse Now AI Editorial System