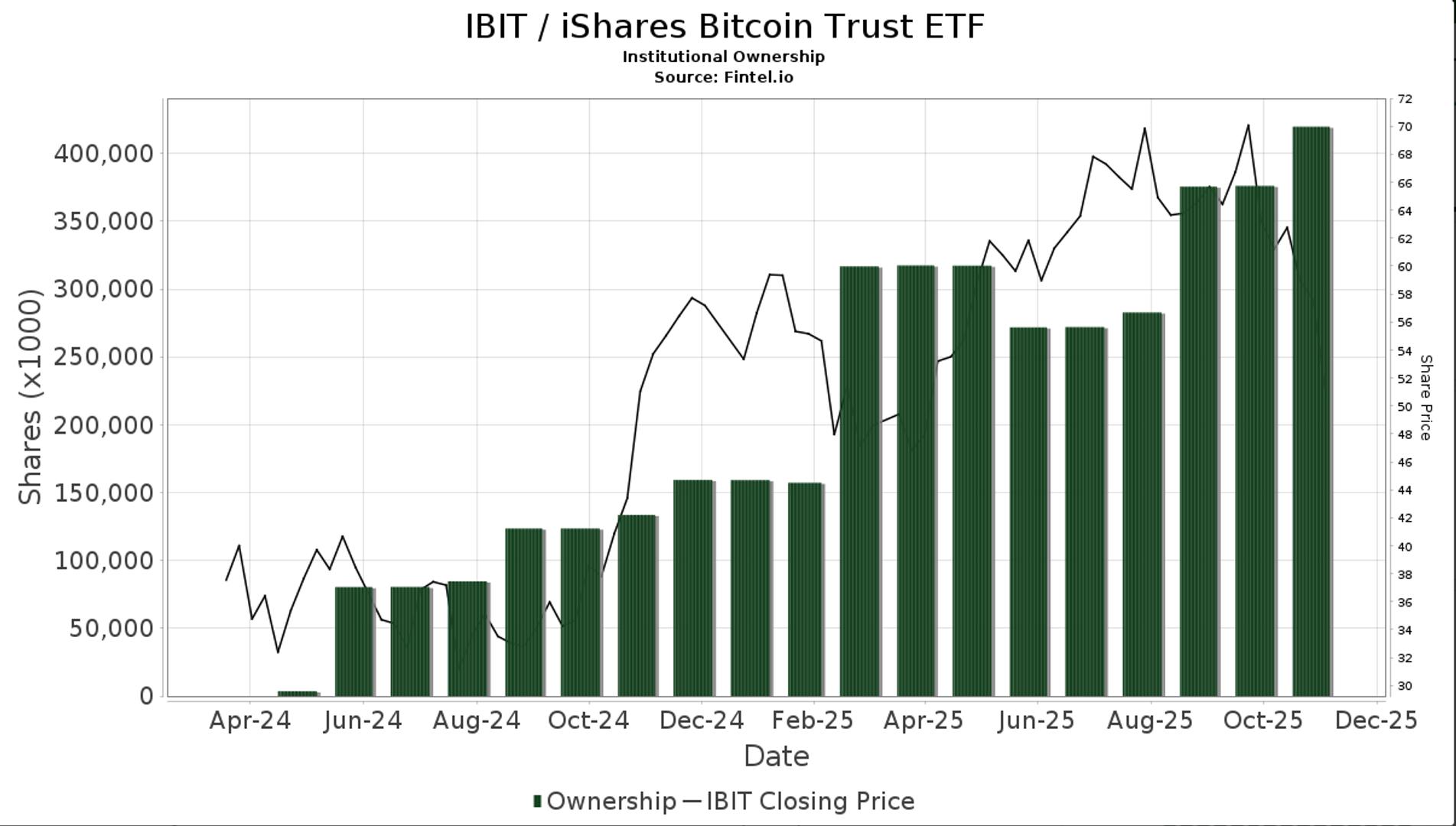

BlackRock’s Own Income Fund Boosts Bitcoin ETF Holdings 14%

NeutralCryptocurrency

- BlackRock’s income fund has increased its holdings in Bitcoin ETFs by 14%, reflecting a strategic move to bolster its position in the cryptocurrency market. This development comes amid fluctuating investor sentiment and significant trading activity in Bitcoin-related financial products.

- The increase in Bitcoin ETF holdings is significant for BlackRock as it signals a renewed confidence in the cryptocurrency market, particularly as institutional investors are becoming more engaged. This could enhance BlackRock's reputation and influence in the rapidly evolving financial landscape.

- The broader context reveals a mixed sentiment in the cryptocurrency market, with recent record trading volumes and institutional investments juxtaposed against notable outflows from Bitcoin ETFs. This duality highlights ongoing volatility and investor caution, as firms like BlackRock navigate the complexities of market dynamics and regulatory considerations.

— via World Pulse Now AI Editorial System