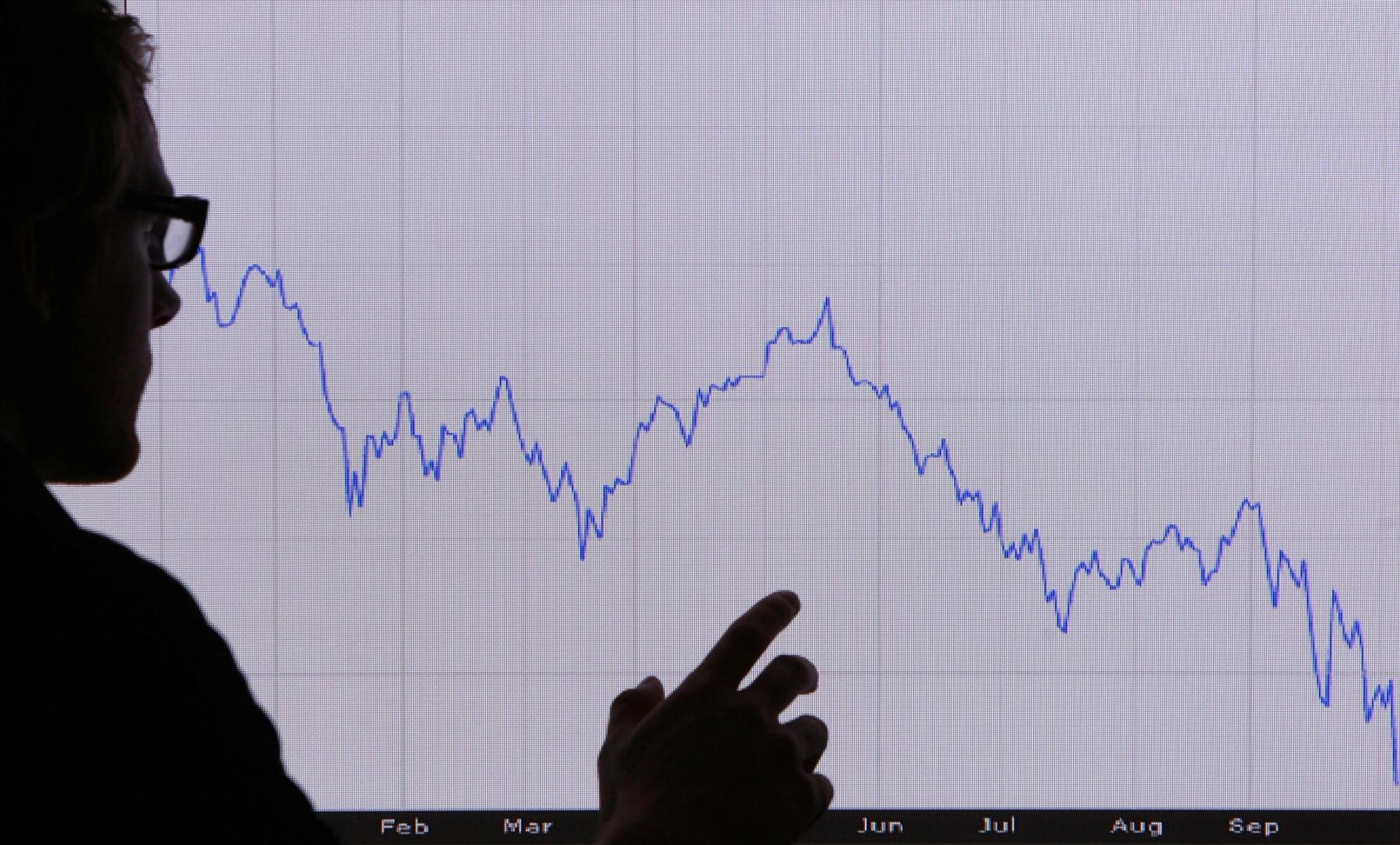

US political turmoil tests ‘institutional confidence’ as crypto ETFs bleed

NegativeCryptocurrency

The recent political turmoil in the US, marked by the 'No Kings' protests and a prolonged government shutdown, is shaking institutional confidence and leading to significant outflows from crypto ETFs. This situation highlights the growing market risk aversion among investors, as political divisions continue to deepen. Understanding these dynamics is crucial, as they not only affect the crypto market but also reflect broader economic sentiments.

— Curated by the World Pulse Now AI Editorial System