XRP whales dump $50M per day: Will it crash the price?

NegativeCryptocurrency

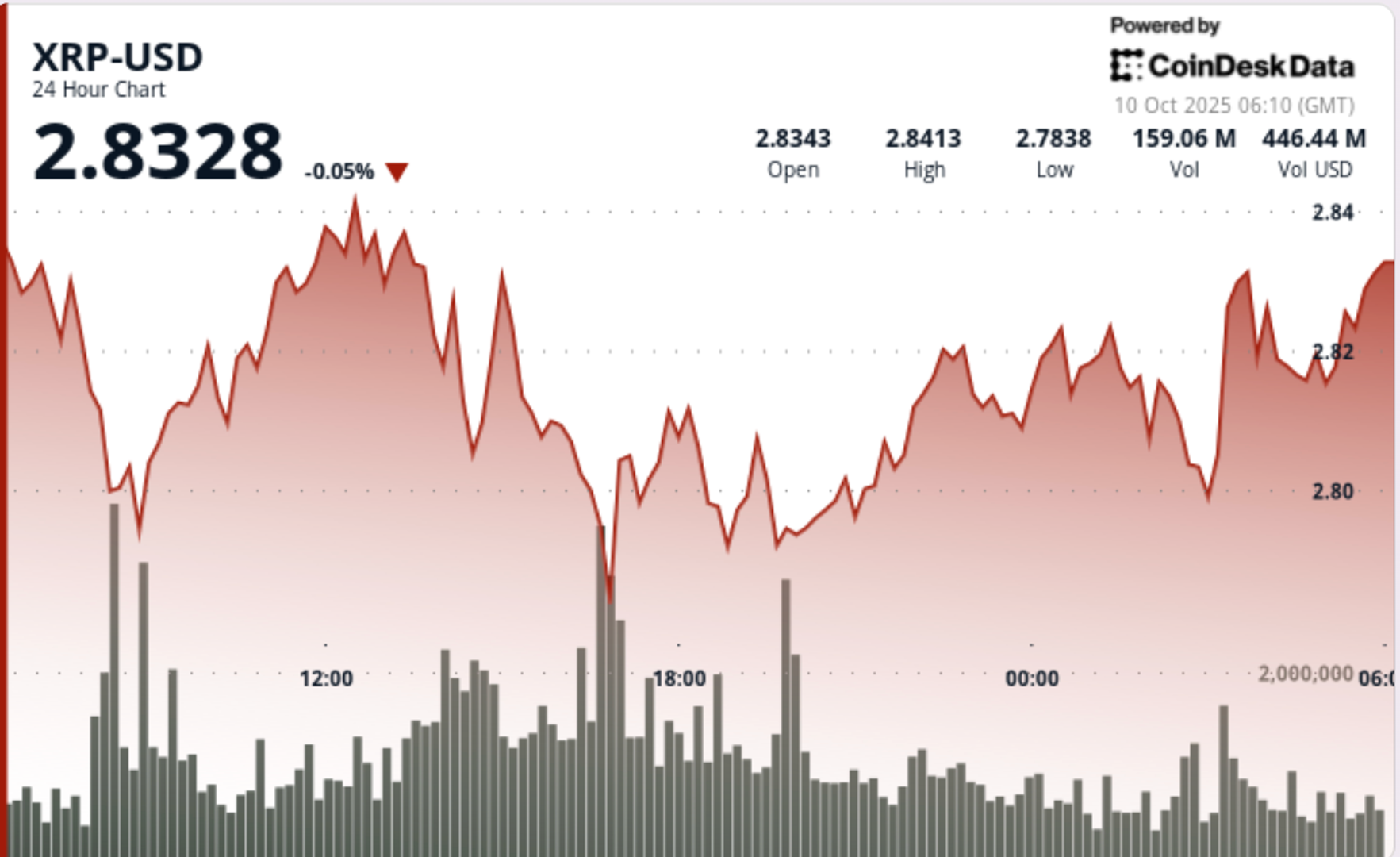

XRP is facing significant pressure as whales are reportedly dumping $50 million worth of the cryptocurrency daily, which could lead to a potential price drop of 22% down to $2.20. This situation is concerning for investors as it indicates increased selling activity and a rising supply on exchanges, coupled with a weakening technical structure. Understanding these dynamics is crucial for anyone involved in the crypto market, as it could signal a larger trend affecting XRP's value.

— Curated by the World Pulse Now AI Editorial System