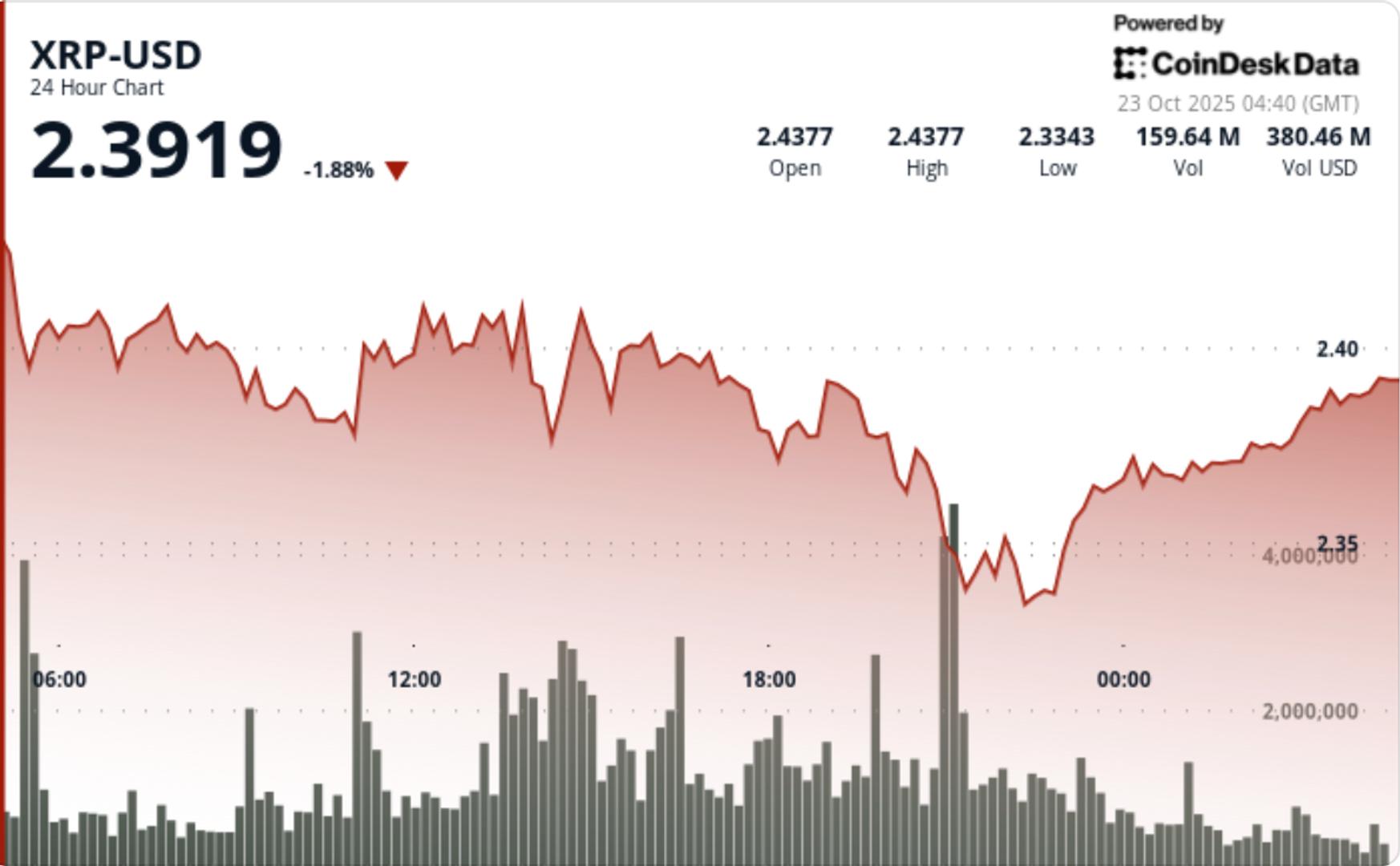

Why XRP price is falling even as trading volume jumps 6% today?

NegativeCryptocurrency

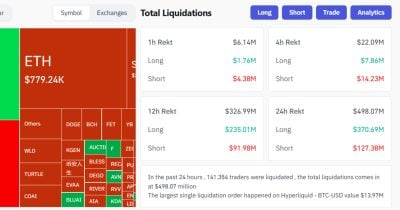

XRP's price is currently experiencing a decline, dropping 0.97% in the last 24 hours and nearly 5.4% over the past week, despite a 6% increase in trading volume. This unusual situation raises questions about whether the market is facing a shakeout or if this is just a temporary dip before a potential recovery. Understanding these dynamics is crucial for investors as they navigate the volatile cryptocurrency landscape.

— Curated by the World Pulse Now AI Editorial System