Ethena taps Flowdesk as USDe climbs $14 billion amid synthetic dollar surge

PositiveCryptocurrency

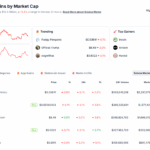

Ethena's partnership with Flowdesk marks a significant milestone as USDe's market cap climbs to over $14 billion, making it the third-largest stablecoin. This collaboration aims to enhance access to USDe and USDtb, which is crucial in the rapidly evolving digital currency landscape. The surge in USDe's value reflects growing confidence in stablecoins, highlighting their importance in providing stability and liquidity in the market.

— Curated by the World Pulse Now AI Editorial System