Crypto Markets Today: Gold Surges Past $4K as Bitcoin Rebounds; BNB Chain Defies Market Cool-Off

PositiveCryptocurrency

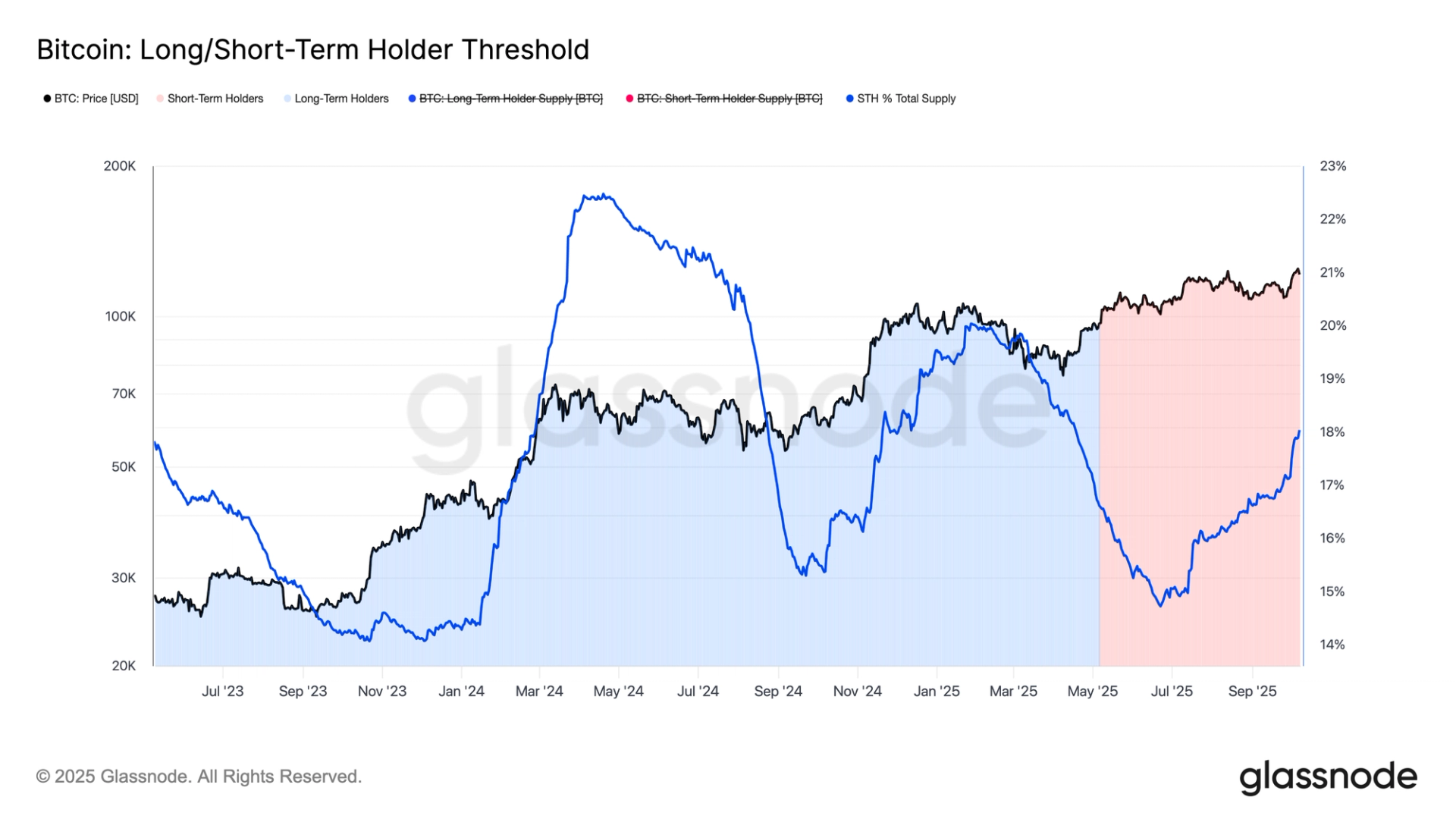

Today, the cryptocurrency markets are buzzing with excitement as gold prices have surged past $4,000, signaling a strong demand for safe-haven assets. Meanwhile, Bitcoin has made a notable rebound, indicating renewed investor confidence. The BNB Chain is also standing out by defying the overall market cool-off, showcasing its resilience and potential for growth. This is significant as it reflects a shift in market dynamics, where traditional assets like gold and innovative cryptocurrencies are both gaining traction, offering investors diverse opportunities.

— Curated by the World Pulse Now AI Editorial System