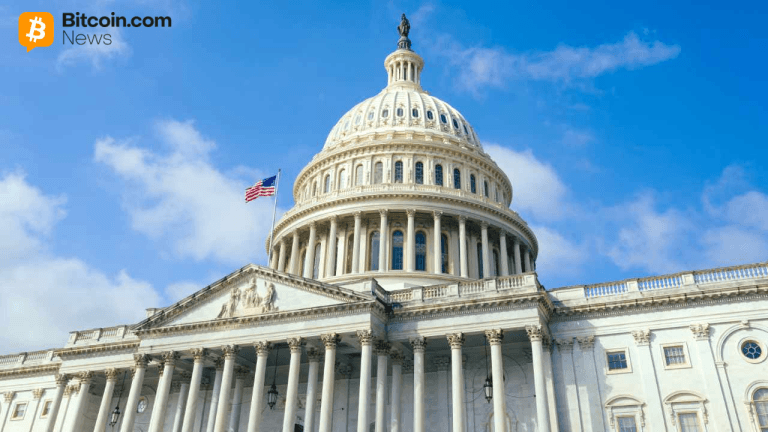

Trump confirms US is in a trade war with China

NegativeCryptocurrency

In a recent statement, President Donald Trump confirmed that the United States is currently engaged in a trade war with China. This acknowledgment highlights the escalating tensions between the two economic giants, which could have significant implications for global trade and economic stability. As tariffs and trade barriers rise, businesses and consumers alike may feel the impact, making it a crucial issue to watch.

— Curated by the World Pulse Now AI Editorial System