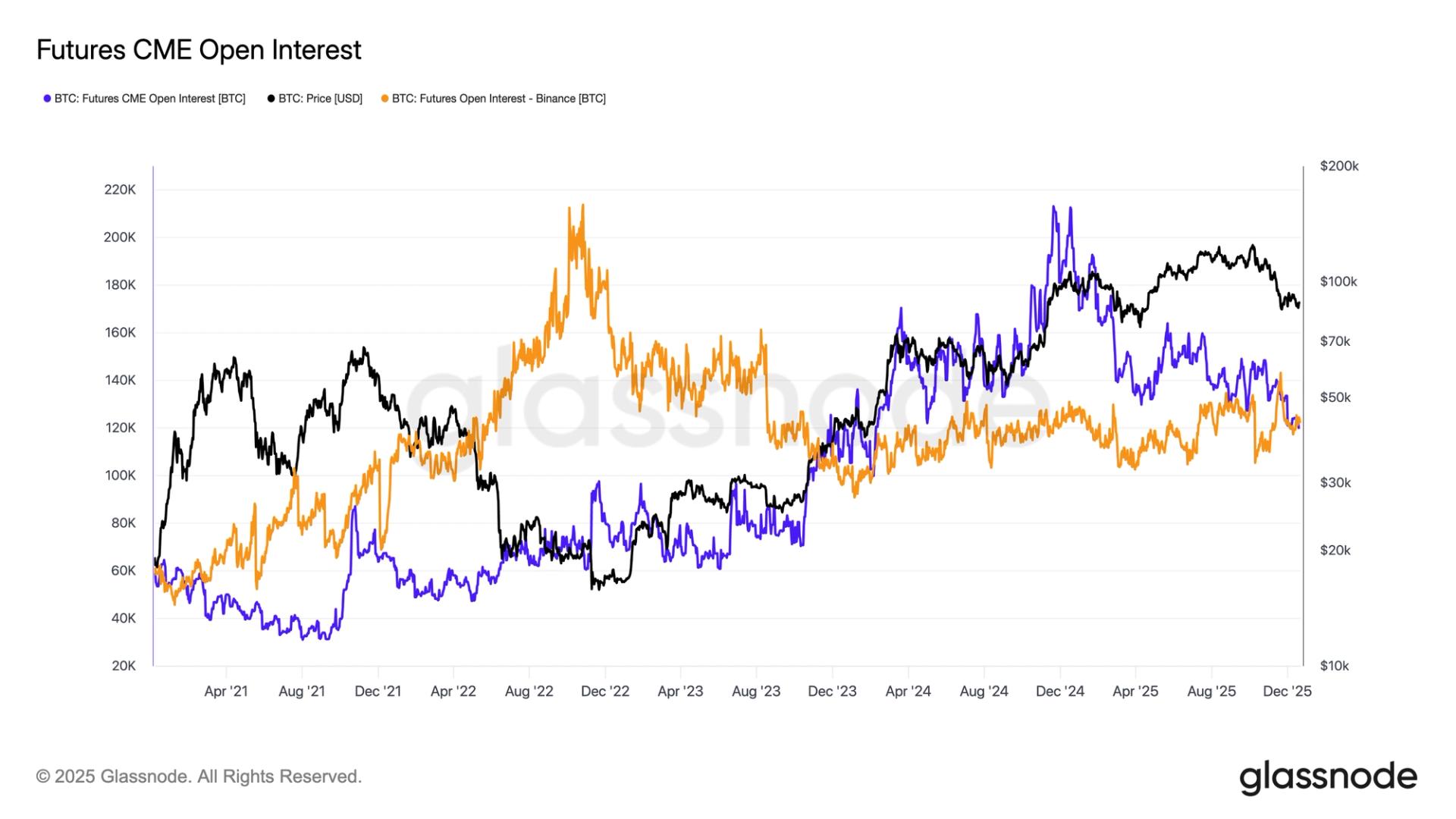

CME loses top spot to Binance in bitcoin futures open interest as institutional demand wanes

NegativeCryptocurrency

- The Chicago Mercantile Exchange (CME) has lost its leading position in bitcoin futures open interest to Binance, attributed to a significant decline in institutional demand and narrowing profitability in basis trading strategies.

- This shift is critical for CME as it reflects a changing landscape in the cryptocurrency futures market, where Binance's growing dominance may impact CME's market share and influence in the sector.

- The broader context reveals a trend of de-leveraging across major trading platforms, with retail inflows to Binance hitting record lows, indicating a lack of confidence among investors amidst ongoing market volatility.

— via World Pulse Now AI Editorial System